Don’t Let Your Student Loans Delay Your Homeownership Plans

Don’t Let Your Student Loans Delay Your Homeownership Plans

Navigating student loans while considering buying a home can be complex. Let's explore how your student debt impacts your ability to qualify for a mortgage and discuss strategies to help you achieve your homeownership goals.

A Bankrate article explains:

“Roughly 60 percent of U.S. adults who have held student loan debt have put off making important financial decisions due to that debt . . . For Gen Z and millennial borrowers alone, that number rises to 70 percent.”

Making significant financial decisions, like buying a home, can be daunting, especially with existing student loans. However, waiting to purchase a home might not always be necessary. Despite having student debt, homeownership could still be feasible. Let's delve into why this might be the case.

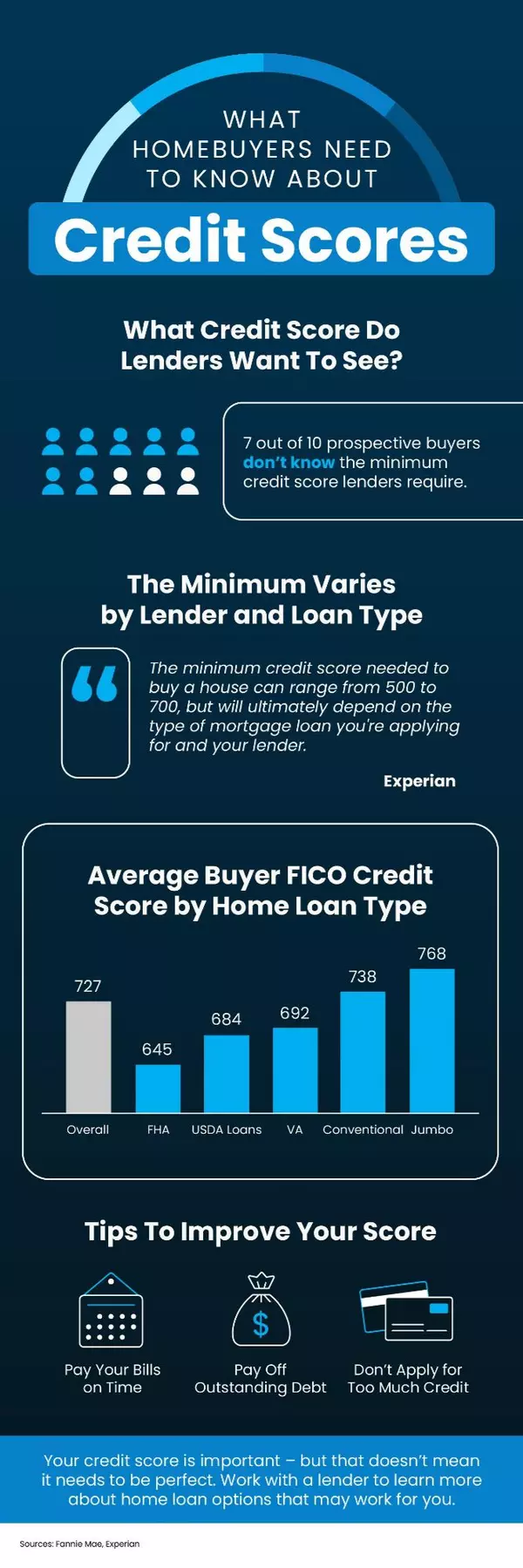

Can You Qualify for a Home Loan if You Have Student Loans?

According to an annual report from the National Association of Realtors (NAR), 38% of first-time buyers had student loan debt and the typical amount was $30,000.

That means other people in a similar situation were able to qualify for and buy a home even though they also had student loans. And you may be able to do the same, especially if you have a steady source of income. As an article from Bankrate says:

“. . . you can have student loans and a mortgage at the same time. . . . If you have student loans and want a mortgage, there are multiple home loan programs you might qualify for . . .”

The key takeaway is, for many people, homeownership is achievable even with student loans.

Navigating the complexities of homeownership with student loans doesn't have to be a solo journey. Consulting with experienced professionals, like a trusted lender, can provide invaluable insights and tailored guidance. They can assess your unique circumstances, outline viable options, and draw from their expertise to illuminate a path forward based on successful strategies employed by others in similar situations.

Bottom Line

Many individuals burdened with student loan debt successfully achieve homeownership. By engaging with a lender, you can explore personalized options and gain clarity on your readiness to pursue your homeownership aspirations.

Categories

Recent Posts

GET MORE INFORMATION