How To Determine if You’re Ready To Buy a Home

How To Determine if You’re Ready To Buy a Home

If you're trying to decide if you're ready to buy a home, there's probably a lot on your mind. You're considering your finances, today's mortgage rates and home prices, the limited supply of homes for sale, and more. You're also weighing how all these factors will impact your decision.

While housing market conditions are definitely important, your personal situation and finances matter too. As an article from NerdWallet says:

“Housing market trends give important context. But whether this is a good time to buy a house also depends on your financial situation, life goals and readiness to become a homeowner.”

Instead of trying to time the market, focus on what you can control. Here are a few questions to help you determine if you're ready to make your move.

1. Do You Have a Stable Job?

Another important factor to think about is how stable you feel your employment is. Buying a home is a significant commitment, and you'll be signing a home loan promising to repay it. Knowing you have a reliable job and a steady stream of income can help put your mind at ease when making such a large purchase.

2. Have You Figured Out What You Can Afford?

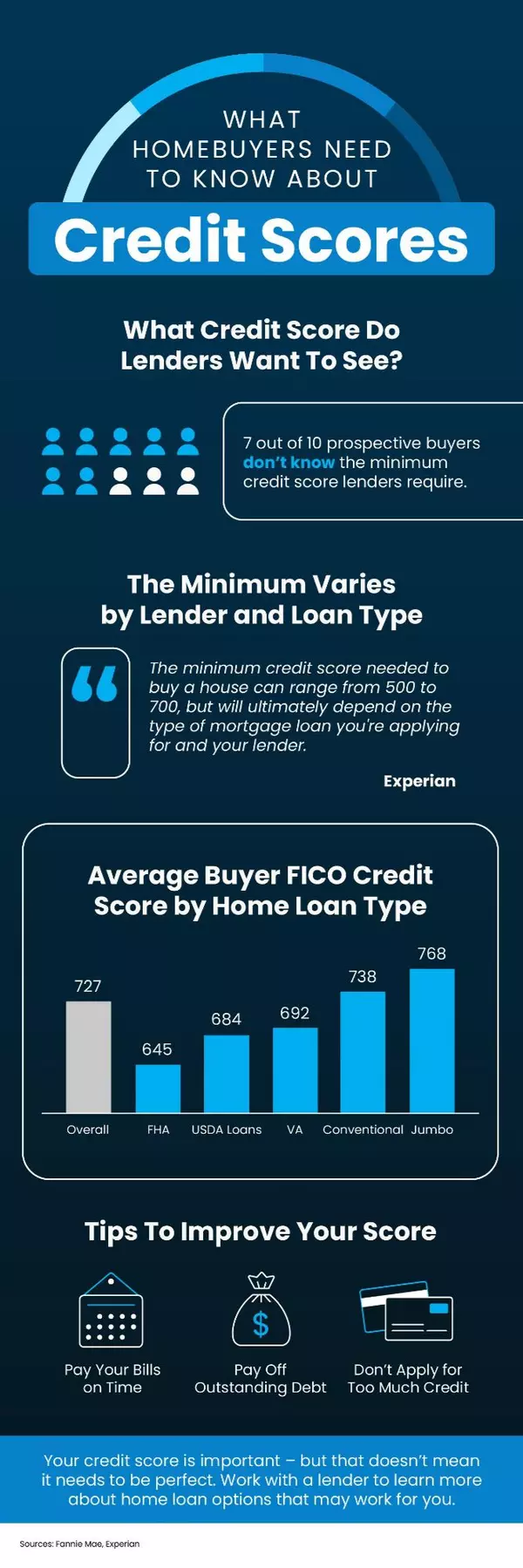

If you have a steady income, the next step is determining what you can afford. This will depend on your spending habits, debt, and other financial factors. To get a clear picture, start by consulting with a trusted lender.

They can guide you through the pre-approval process and inform you about what you’re qualified to borrow, current mortgage rates, your estimated monthly payments, closing costs, and other expenses you’ll need to budget for. This will help you make an informed decision about whether you’re ready to buy.

3. Do You Have an Emergency Fund?

Another crucial factor is ensuring you’ll have enough cash reserves in case of an emergency. While it’s not pleasant to think about, it’s essential. You don’t want to overextend yourself on a house and be unable to handle unexpected financial challenges. As CNET says:

“You’ll want to have a financial cushion that can cover several months of living expenses, including mortgage payments, in case of unforeseen circumstances, such as job loss or medical emergencies.”

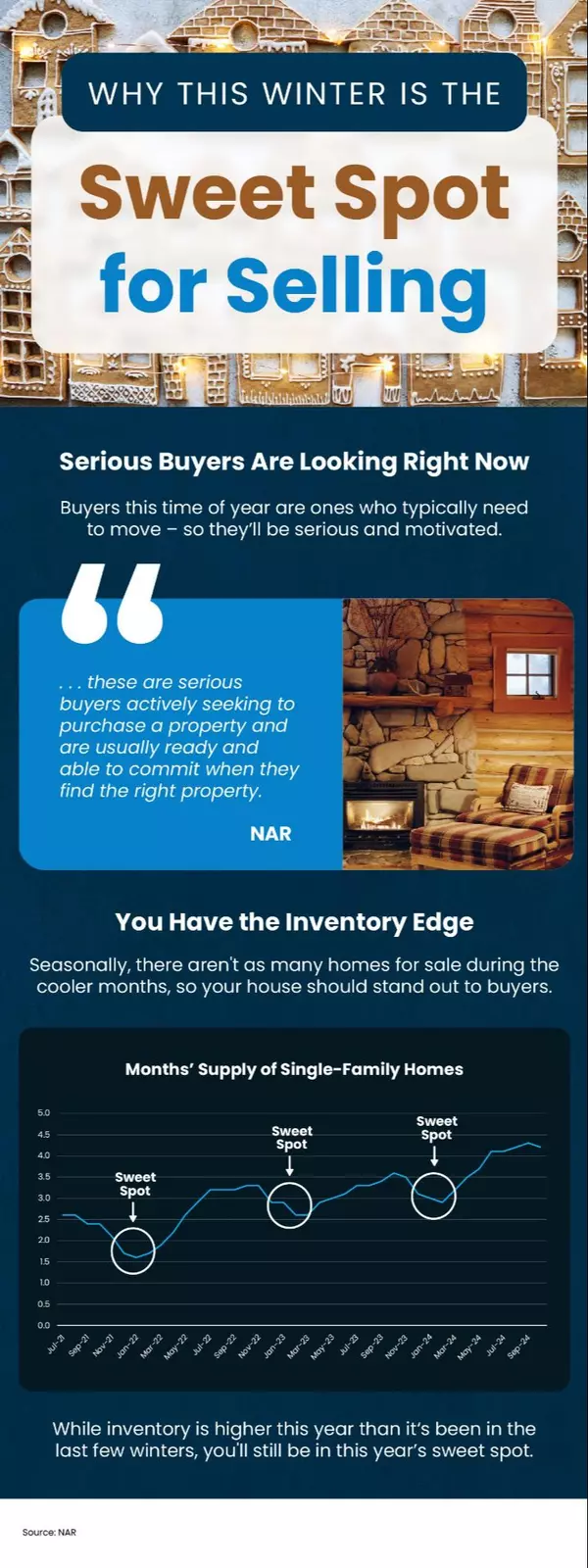

4. How Long Do You Plan To Live There?

It was mentioned above, but buying a home involves some upfront expenses. And while you’ll get that money back (and more) as you gain equity, that process takes time. If you plan to move too soon, you may not recoup your investment. For example, if you’re looking to sell and move again in a year, it might not make sense to buy right now. As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains:

“Five years is a good, comfortable mark. If the price of your home appreciates considerably, then even three years would be fine.”

So, think about your future. If you plan to transfer to a new city with the upcoming promotion you’re working toward or you anticipate your loved ones will need you to move closer to take care of them, that’s something to factor in.

5. Above all else, the most important question to answer is: do you have a team of real estate professionals in place?

If not, connecting with a trusted local agent and lender is a smart first step. These professionals can discuss your options and help you determine if you’re ready to buy now or if there are a few more steps you need to take first.

Bottom Line

If you want to discuss everything you need to consider to determine if you’re ready to buy, let’s connect.

Categories

Recent Posts

GET MORE INFORMATION