Is It Better To Rent Than Buy a Home Right Now?

Is It Better To Rent Than Buy a Home Right Now?

You've probably seen news reports recently suggesting that renting may be more affordable than buying a home at the moment. While this might be true in some markets if you only focus on typical monthly payments, there’s a key aspect missing from these calculations: home equity. Here's why home equity plays a significant role and why it's important to keep in mind when making your decision.

What the Headlines Are Based on

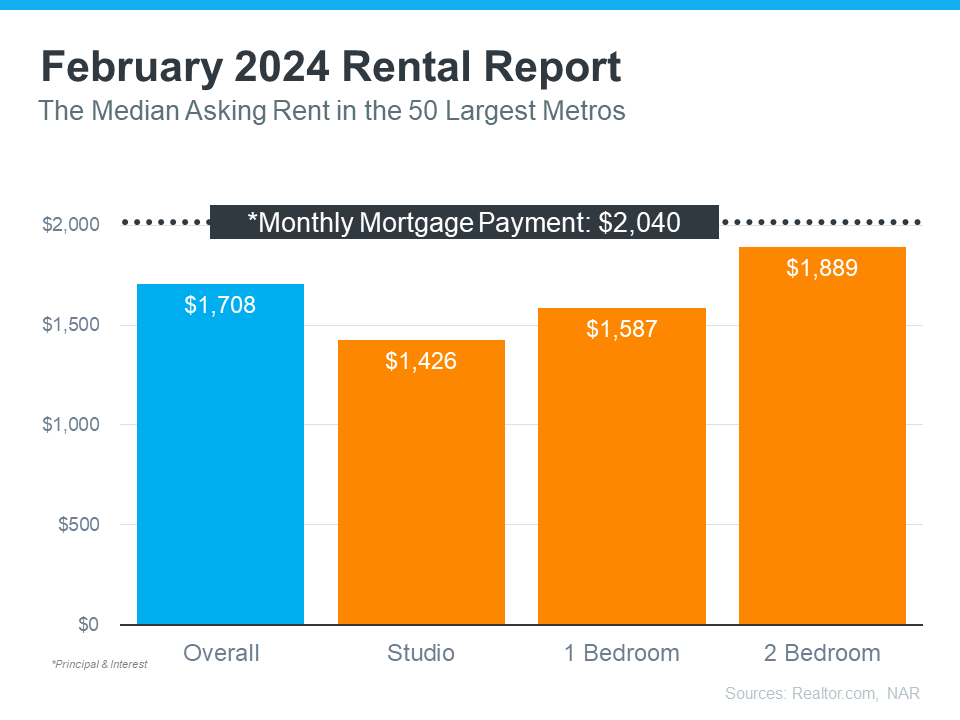

The graph below provides a comparison between the median rental payment according to Realtor.com and the median mortgage payment from the National Association of Realtors (NAR). The data illustrates that, particularly if you don't require much living space, renting can be more affordable on a monthly basis than buying a home:

When considering properties with 2 bedrooms, the difference between the median rent and median mortgage payment becomes smaller, making the monthly mortgage payment of $2,040 more comparable to the median rent of $1,889. This difference of around $151 per month may seem more manageable for many. However, when you account for home equity, the situation changes significantly.

How Equity Changes the Game

When you rent, your monthly payments cover your housing costs but contribute nothing towards long-term wealth. Once you move out, the money you've spent on housing each month is gone.

On the other hand, buying a home allows you to build equity with every mortgage payment. As you pay down your loan, you gain ownership and increase your equity. This equity further grows as home values rise, which they typically do over time.

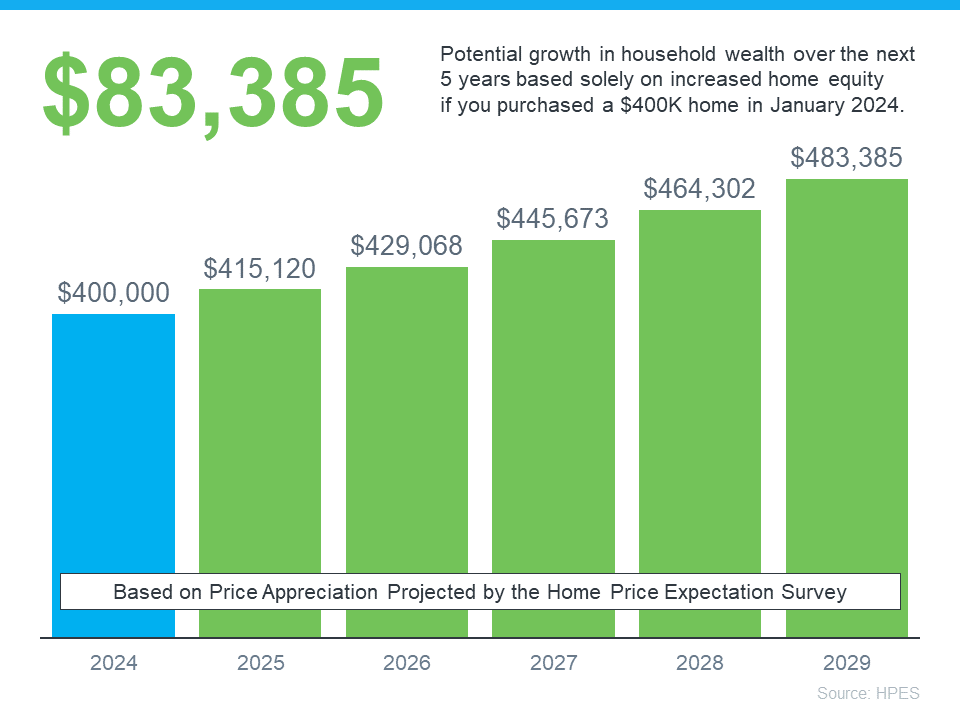

The Home Price Expectations Survey (HPES), published quarterly by Fannie Mae and Pulsenomics, surveys over 100 economists, real estate professionals, and market strategists. They predict that home prices will continue to rise over the next five years, indicating a potential for substantial equity growth.

Here's a visual representation of how equity can accumulate quickly based on projections from the HPES. This can help you understand the potential benefits of investing in a home rather than just renting. (see graph below):

Imagine you purchased a home for $400,000 at the start of this year. Chances are, since you bought, you plan to stay put for a while. Based on the HPES projections, if you live there for 5 years, you could end up gaining over $83,000 in household wealth as your home grows in value.

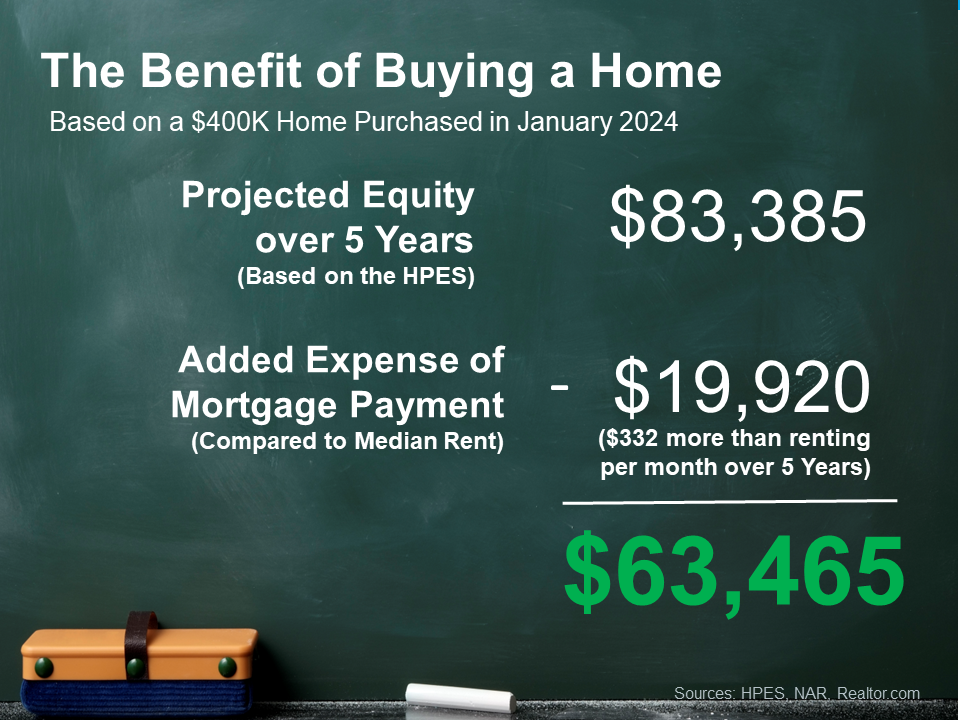

Here’s how that stacks up compared to renting, using the overall median rent from above:

While renting may help you save a bit on your monthly payments, it doesn't provide the opportunity to build equity in a property.

The main takeaway is that whether to rent or buy depends on your financial situation. If the numbers don't work for you, it may not be the right time to buy. However, if you're ready and able, considering the potential for equity growth might make buying a more attractive option for the future.

Bottom Line

Ultimately, buying a home offers a unique advantage over renting: the opportunity to build equity. If you're interested in benefiting from long-term home price appreciation, let's discuss your options.

Categories

Recent Posts

GET MORE INFORMATION