Is It Getting More Affordable To Buy a Home?

Is It Getting More Affordable To Buy a Home?

In recent times, discussions about the challenges of buying a home have been prominent, particularly regarding tight affordability. However, there are indications that conditions are starting to ease up and may continue to improve over the year. According to Elijah de la Campa, Senior Economist at Redfin, here's what you need to know:

“We’re slowly climbing our way out of an affordability hole, but we have a long way to go. Rates have come down from their peak and are expected to fall again by the end of the year, which should make homebuying a little more affordable and incentivize buyers to come off the sidelines.”

Here’s a look at the latest data for the three biggest factors that affect home affordability: mortgage rates, home prices, and wages.

1. Mortgage Rates

This year, mortgage rates have seen some fluctuation, hovering between the upper 6% and low 7% range. Although these rates are higher than they were a couple of years ago, there is a glimmer of good news.

Despite recent ups and downs, current rates are lower than they were last fall when they almost hit 8%. Furthermore, many experts predict that rates will decrease somewhat throughout the year. A recent article from Bright MLS sheds more light on this topic:

“Expect rates to come down in the second half of 2024 but remain above 6% this year. Even a modest drop in rates will bring both more buyers and more sellers into the market.”

Any drop in rates can make a difference for you. When rates go down, you can afford the home you really want more easily because your monthly payment would be lower.

2. Home Prices

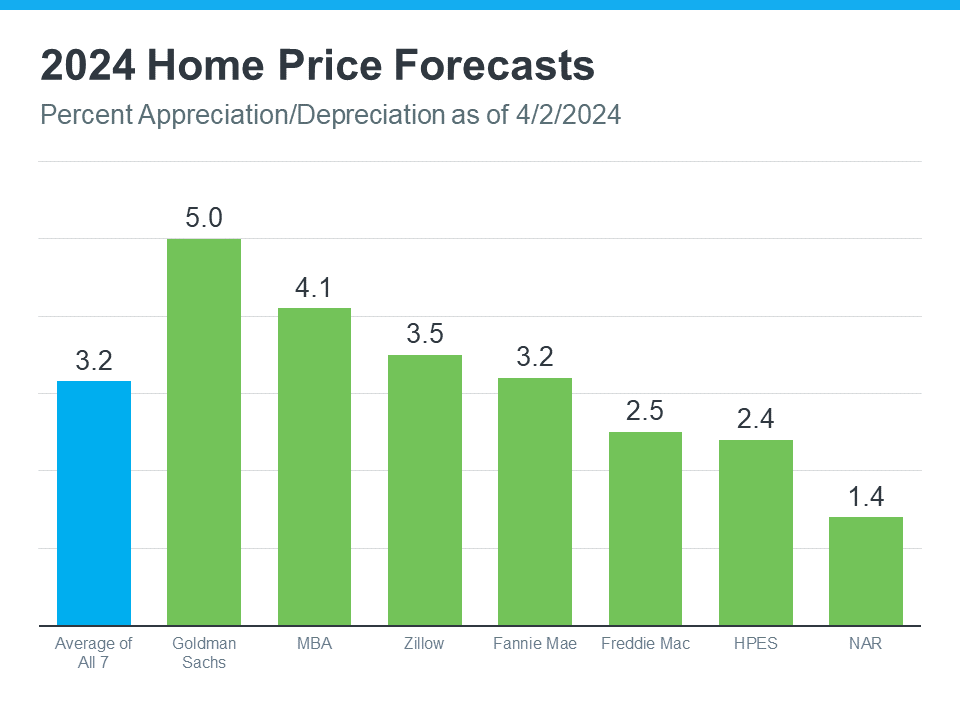

The other major factor to consider is home prices. While most experts expect them to continue rising this year, the increase is anticipated to happen at a more moderate rate. This is due to the fact that while there are more homes available on the market this year, the inventory is still insufficient to meet the high demand from potential buyers. The graph below illustrates the latest 2024 home price forecasts from seven different organizations:

These forecasts are actually good news for you because it means the prices aren't likely to shoot up sky high like they did during the pandemic. That doesn’t mean they’re going to fall – they'll just rise at a slower pace.

3. Wages

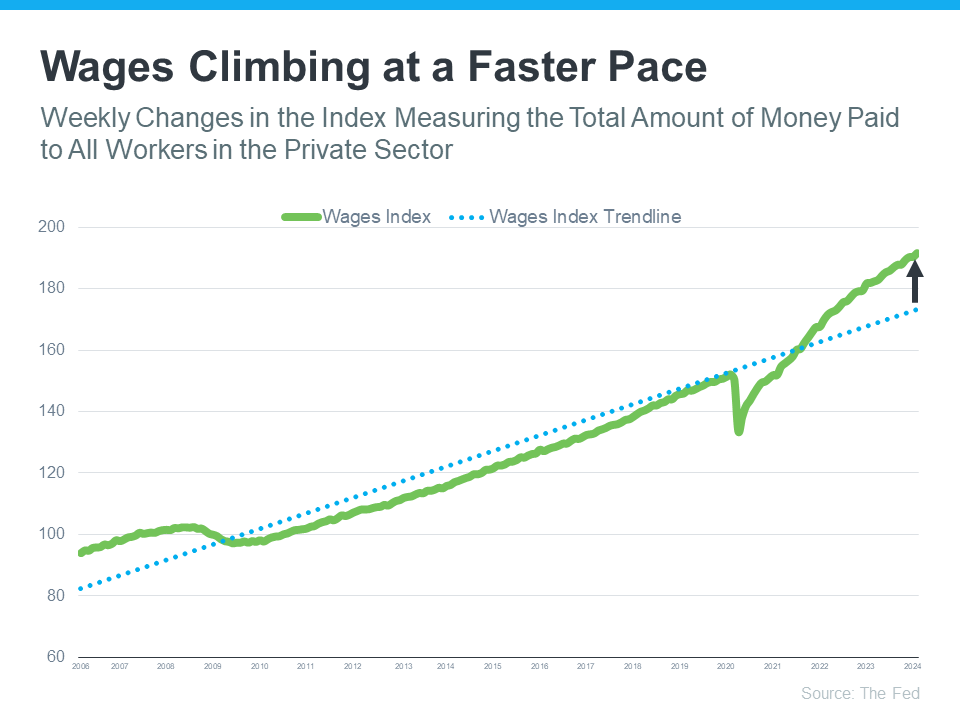

One factor helping affordability right now is the fact that wages are rising. The graph below uses data from the Federal Reserve to show how wages have been growing over time:

Take a look at the blue dotted line in the graph. It demonstrates how wages generally increase over time. If you focus on the right side of the graph, you can see that wages are currently rising at a pace faster than usual.

Here's how this benefits you: If your income has grown, it becomes easier to afford a home because you can allocate a smaller portion of your paycheck towards your monthly mortgage payment.

Bottom Line

When you consider all these factors together, it becomes clear that there are positive trends for home affordability. Mortgage rates are expected to decrease later this year, home prices are rising at a more moderate pace, and wages are increasing faster than usual. These trends suggest a favorable outlook for your ability to afford a home.

Categories

Recent Posts

GET MORE INFORMATION