Questions You May Have About Selling Your House

Questions You May Have About Selling Your House

There’s no denying that mortgage rates are having a significant impact on today’s housing market. This might leave you wondering if it still makes sense to sell your house and make a move.

Here are three of the top questions you may be asking, along with the data to help answer them.

1. Should I Wait To Sell?

If you’re considering waiting to sell until mortgage rates come down, here's what you need to know: so are many others.

While mortgage rates are forecasted to come down later this year, if you wait for that to happen, you may face a lot more competition as other buyers and sellers jump back in. As Bright MLS says:

“Even a modest drop in rates will bring both more buyers and more sellers into the market.”

That means if you wait it out, you’ll have to deal with things like prices rising faster and more multiple-offer scenarios when you buy your next home.

2. Are Buyers Still Out There?

But that doesn’t mean no one is moving right now. While some people are holding off, there are still plenty of buyers active today. Here’s the data to prove it.

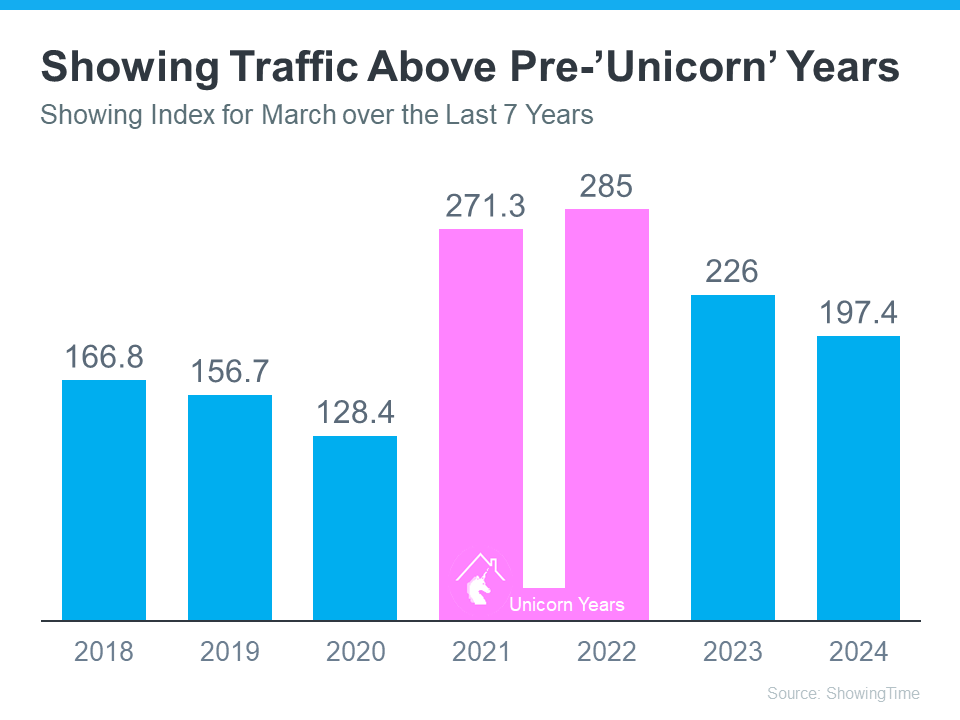

The ShowingTime Showing Index measures how frequently buyers are touring homes. The graph below uses that index to show buyer activity for March (the latest data available) over the past seven years:

You can see demand has dipped somewhat since the 'unicorn' years (shown in pink), which were characterized by exceptionally high activity. This decline is due to several market factors, including higher mortgage rates, rising prices, and limited inventory. However, to truly understand today’s demand, it's important to compare where we are now with the last normal years in the market (2018-2019), rather than the abnormal 'unicorn' years.

Focusing on the blue bars, representing the normal years, provides a clearer perspective on how 2024 stacks up. This comparison gives you a more realistic view of the current market demand.

Nationally, demand is still high compared to the last normal years in the housing market (2018-2019). And that means there’s still a market for your house to sell.

3. Can I Afford To Buy My Next Home?

And if you’re worried about how you’ll afford your next move with today’s rates and prices, consider this: you probably have more equity in your current home than you realize.

Homeowners have gained record amounts of equity over the past few years. This equity can significantly impact your ability to buy your next home. You might even have enough to be an all-cash buyer and avoid taking out a mortgage altogether. As Jessica Lautz, Deputy Chief Economist at the National Association of Realtors (NAR), says:

“ . . . those who have earned housing equity through home price appreciation are the current winners in today's housing market. One-third of recent home buyers did not finance their home purchase last month—the highest share in a decade. For these buyers, interest rates may be less influential in their purchase decisions.”

Bottom Line

If you’ve had these three questions on your mind and they’ve been holding you back from selling, hopefully, this information helps. A recent survey from Realtor.com shows that more than 85% of potential sellers have been considering selling for over a year. This indicates that many sellers, like you, are on the fence.

However, the same survey also talked to sellers who recently decided to take the plunge and list. Interestingly, 79% of those recent sellers wish they’d sold sooner.

If you want to discuss any of these questions further or need more information, let’s connect.

Categories

Recent Posts

GET MORE INFORMATION