This Is the Sweet Spot Homebuyers Have Been Waiting For

This Is the Sweet Spot Homebuyers Have Been Waiting For

After months of waiting due to high mortgage rates and affordability concerns, many homebuyers now have a window of opportunity to enter the market. With rates trending downward, this could be an ideal time for buyers to act—an opportunity that might not last long.

If you've been holding off on making your move, it might be time to reconsider. As you weigh whether to buy now or wait, ask yourself: What will everyone else do?

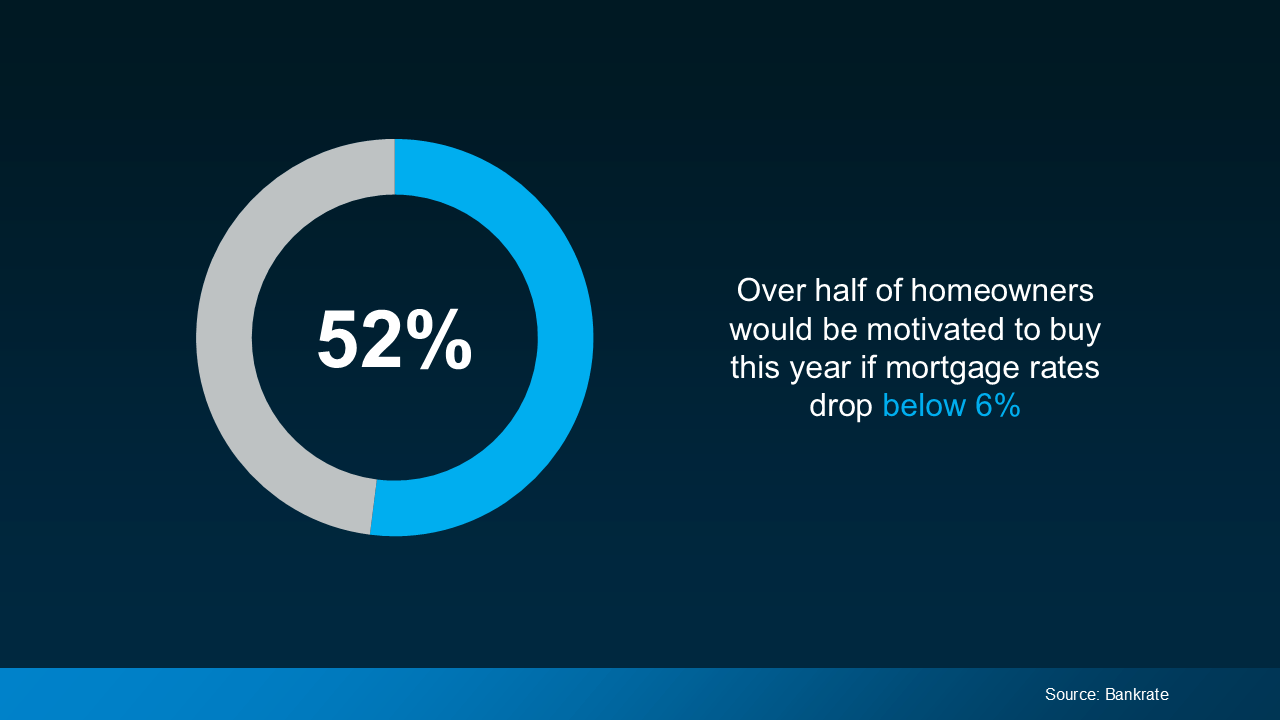

The reality is that if mortgage rates keep falling, as experts predict, more buyers will re-enter the market. A recent survey from Bankrate reveals that over half of homeowners would be motivated to buy this year if rates drop below 6%.

(see graph below):

With rates currently hovering in the low 6% range, we're not far from hitting the threshold that could ignite more buyer activity. The key takeaway? Once rates dip into the 5% range, buyer competition will intensify.

That spike in demand is likely to drive home prices higher, which could offset some of the advantages you'd gain from a lower interest rate. As Nadia Evangelou, Senior Economist and Director of Real Estate Research at the National Association of Realtors (NAR), explains:

“The downside of increased demand is that it puts upward pressure on home prices as multiple buyers compete for a limited number of homes. In markets with ongoing housing shortages, this price increase can offset some of the affordability gains from lower mortgage rates.”

So, while waiting to buy might seem like a good strategy, it could actually backfire if rising home prices outpace the savings you’d get from slightly lower mortgage rates.

What This Means for You

Right now, you have the opportunity to get ahead of the competition. The current market is a sweet spot for buyers because many others are still waiting on the sidelines. With fewer active buyers, there’s less competition for homes. Plus, affordability has already improved thanks to recent drops in mortgage rates, making homeownership more attainable. As Mike Simonsen, Founder of Altos Research, explains:

“Mortgage payments on the typical-price home are 7% lower than last year and are 13% lower than the peak in May 2024.”

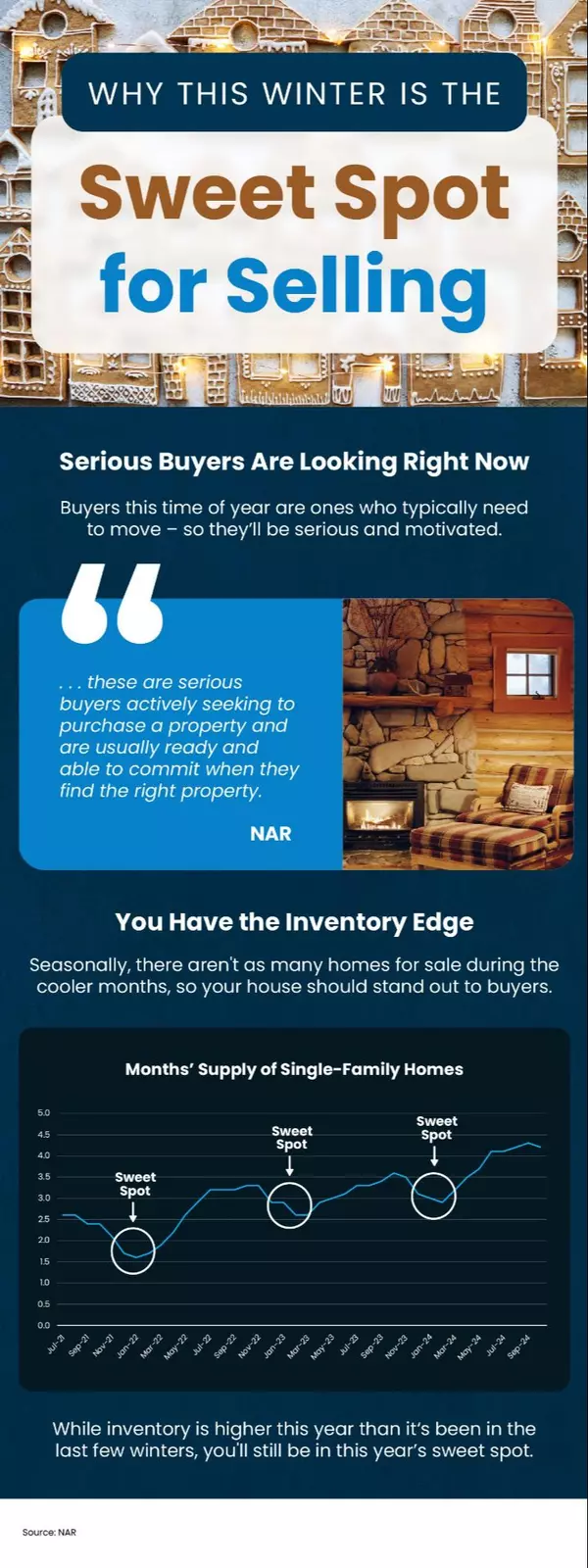

And although the number of homes for sale remains relatively low, it's actually higher than we've seen in recent years. According to Ralph McLaughlin, Senior Economist at Realtor.com:

“The number of homes actively for sale continues to be elevated compared with last year, growing by 35.8%, a 10th straight month of growth, and now sits at the highest since May 2020.”

This means you currently have more options available than you've seen in quite some time.

With fewer buyers actively searching, better affordability, and a wider selection of homes, now is your chance to find the perfect home before competition ramps up again.

Why Waiting Could Cost You

If you're holding out for the perfect time to buy, keep in mind that timing the market is incredibly difficult. The longer you wait, the greater the risk that market conditions may change—potentially not in your favor. As Greg McBride, Chief Financial Analyst at Bankrate, explains:

“It’s one of those things where you should be careful what you wish for. A further drop in mortgage rates could bring a surge of demand that makes it tougher to actually buy a house.”

Bottom Line

Don’t wait until you're facing more competition and rising prices. Right now, you're in a buyer's sweet spot, with better opportunities available. Let’s connect and ensure you’re making the most of this moment to buy your home.

Categories

Recent Posts

GET MORE INFORMATION