Why Today’s Foreclosure Numbers Won’t Trigger a Crash

Why Today’s Foreclosure Numbers Won’t Trigger a Crash

With everything becoming more expensive, it’s understandable to worry about how rising costs might affect the housing market. Many fear that high prices and tighter budgets could lead to more homeowners falling behind on their mortgage payments, triggering a wave of foreclosures.

But before concerns about a market crash set in, here’s what’s really happening. The good news is: the latest foreclosure data shows no wave on the horizon.

How Today’s Market Is Different from 2008

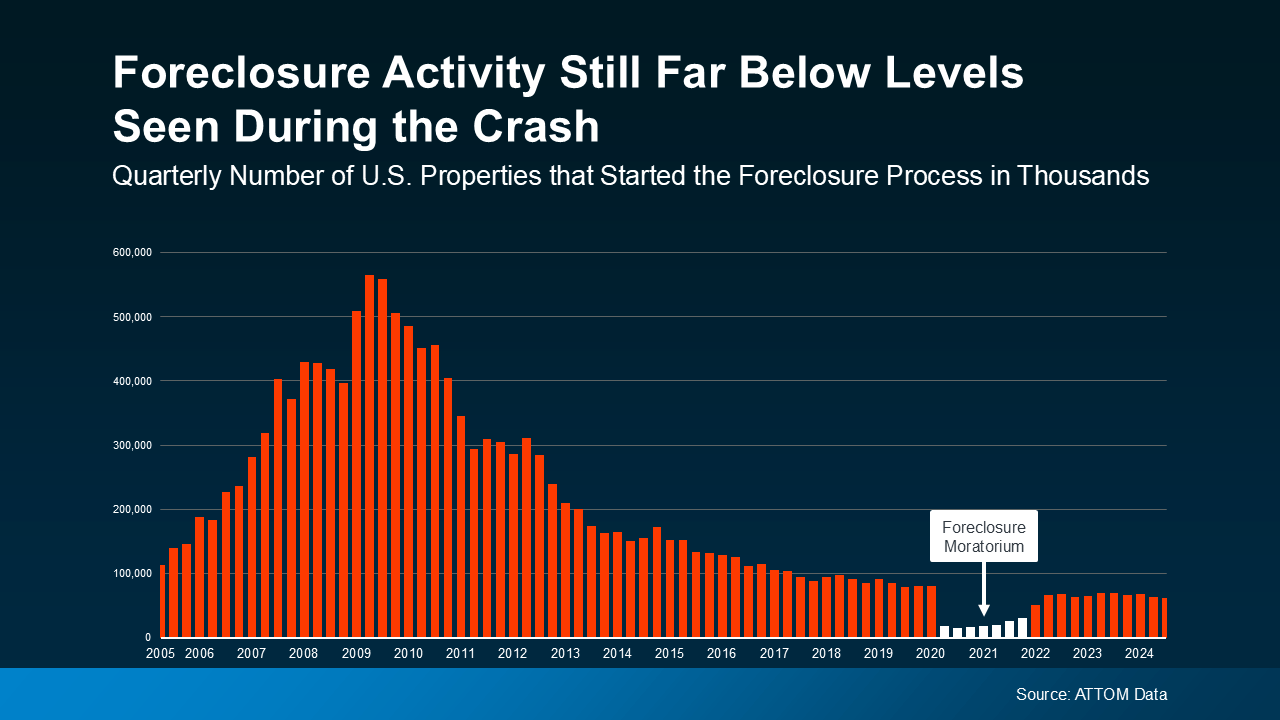

Let’s put those fears to rest by looking at the bigger picture. Data from ATTOM, a property data provider, shows that the number of homeowners entering foreclosure is far from the levels seen after 2008. During the housing crash, foreclosure numbers spiked significantly. Today, the numbers are much lower – even decreasing slightly in the latest report. The current situation is clearly different from what happened during the market crash (see graph below).

Homeowners today are in a much stronger position than they were during the 2008 crisis. One key reason is the significant equity they’ve built in their homes. This means that even if some homeowners face financial difficulties, they’re less likely to go into foreclosure because they can sell their property for a profit instead of defaulting on their mortgage.

During 2020 and 2021, the numbers were kept artificially low due to a foreclosure moratorium (shown in white on the graph). This policy helped millions of homeowners stay in their homes despite financial hardships. Now that the moratorium has ended, a slight increase in foreclosure filings is expected, but it remains well below historic levels.

As Bankrate explains, having more equity acts as a cushion, giving homeowners the flexibility to navigate economic challenges without facing foreclosure.

“In the years after the housing crash, millions of foreclosures flooded the housing market, depressing prices. That’s not the case now. Most homeowners have a comfortable equity cushion in their homes.”

This equity serves as a safety net, helping many homeowners avoid foreclosure during times of financial difficulty. Even if they’re having trouble keeping up with monthly payments, selling their home can offer a way out without resorting to foreclosure. This stands in stark contrast to the 2008 crash, when many homeowners owed more on their mortgages than their properties were worth, leaving them with limited options.

What’s Ahead for the Housing Market

It’s true that the rising cost of living is putting pressure on many people. However, this doesn’t indicate an impending wave of foreclosures.

The equity homeowners have built acts as a cushion, keeping foreclosure rates low. With this financial buffer, homeowners have more flexibility and options to prevent foreclosure.

Bottom Line

While everyday expenses like gas and food have become more expensive, this doesn’t signal an impending foreclosure crisis. Current data confirms that the market is nowhere near a surge in foreclosures. Compared to the 2008 crash, homeowners today are in a much healthier financial position, largely due to the significant equity they’ve built up.

Categories

Recent Posts

GET MORE INFORMATION