Home Prices Aren’t Declining, But Headlines Might Make You Think They Are

Home Prices Aren’t Declining, But Headlines Might Make You Think They Are

If you've seen recent news about home sellers slashing prices, it's a prime example of how headlines often terrify rather than clarify. Here's what's really happening with prices.

The bottom line is that home prices are still higher than they were at this time last year, and they're expected to keep rising, albeit at a slower pace.

But a recent article from Redfin notes,

“Price Drops Hit Highest Level in 18 Months As High Rates Dampen Buyer Demand.”

And that might make you think prices are declining.

While it's true that the latest report from Realtor.com shows 16.6% of homes on the market had price reductions in May, up from 12.7% last May, this doesn't mean overall home prices are falling.

The key is knowing the difference between the asking price and the sold price.

Understanding Asking Price vs. Sold Price

In essence, the asking price, also known as a listing price, is the amount a seller hopes to get for their home when they list it. However, sellers can't simply put any price tag on their house and expect to sell it for top dollar. Today's buyers are savvy and less willing to pay a premium, especially as their budgets are strained by higher mortgage rates. Consequently, sellers need to adjust their expectations.

Based on market conditions and the offers received, the asking price can change. If a seller isn't attracting much interest, they might revise the price to reignite buyer interest – often because they initially overpriced the home. This is where price reductions come into play, and when you see "price drops" in a headline, it can give the impression that home prices are declining.

Mike Simonsen, CEO and Founder of Altos Research, says:

“Not only is the share of homes with price cuts elevated compared to one year ago, but more price cuts are happening each week than last year.”

On the other hand, the final sold price is the amount a buyer actually pays when the transaction is complete.

Here’s the most important thing to note: Actual sold prices are still rising, and they’re expected to continue to do so at least over the next 5 years.

What Does This Mean for Home Prices?

So, while there's been an increase in price reductions recently, this doesn't mean overall home values are declining.

Instead, it’s a sign that demand is moderating. As a result, sellers are adjusting their expectations to align with today's market reality.

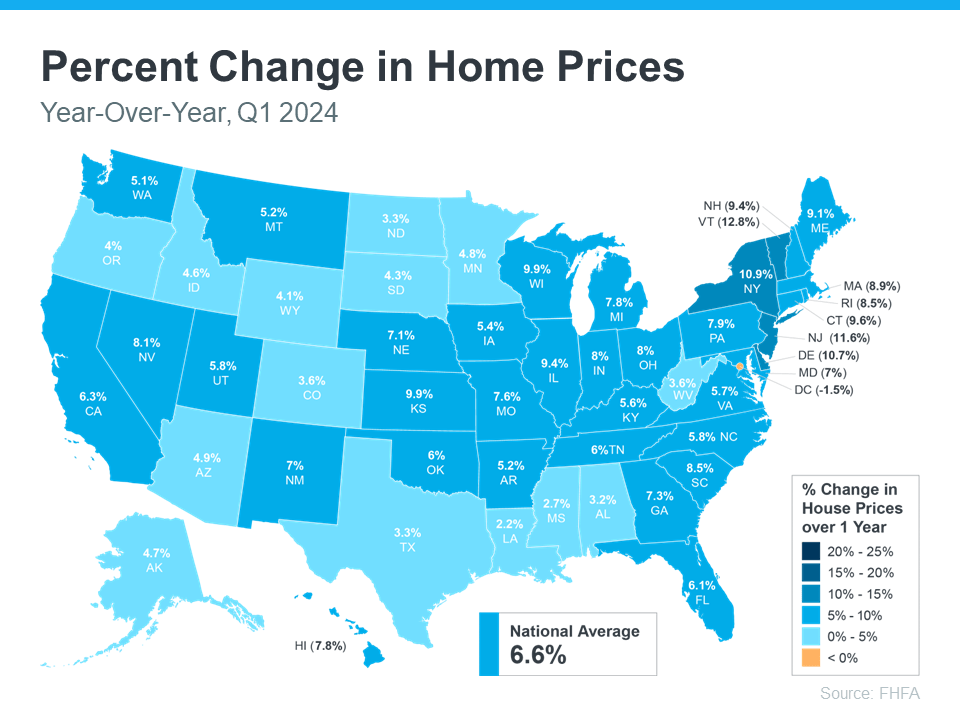

Even with more price reductions, home values are still growing annually, as they typically do in the housing market. According to the Federal Housing Finance Agency (FHFA), home prices increased by 6.6% over the past year (see below):

This map shows how prices rose almost everywhere in the country, indicating the market is not in decline.

While seller price reductions often suggest that prices may moderate in the coming months, as experts have been predicting, they aren't necessarily a cause for alarm. The same article from Redfin also states:

“. . .those metrics suggest sale-price growth could soften in the coming months as persistently high mortgage rates turn off homebuyers. For now, the median-home sale price is up 4.3% year over year to another record high. . .”

And with inventory as tight as it is today, price moderation is much more likely in the upcoming months than price declines.

Why This Is Good News for Buyers and Sellers

For buyers, more realistic asking prices mean a better chance of securing a home at a fair price. It also means you can enter the market with more confidence, knowing prices are stabilizing rather than continuing to skyrocket.

For sellers, understanding the need to adjust your asking price can lead to faster sales and fewer price negotiations. Setting a realistic price from the start can attract more serious buyers and result in smoother transactions.

Bottom Line

While the uptick in price reductions might seem troubling, it’s not a cause for concern. It reflects a market adjusting to new conditions. Home prices are still growing, just at a more moderate pace.

Categories

Recent Posts