The Benefits of Using Your Equity To Make a Bigger Down Payment

The Benefits of Using Your Equity To Make a Bigger Down Payment

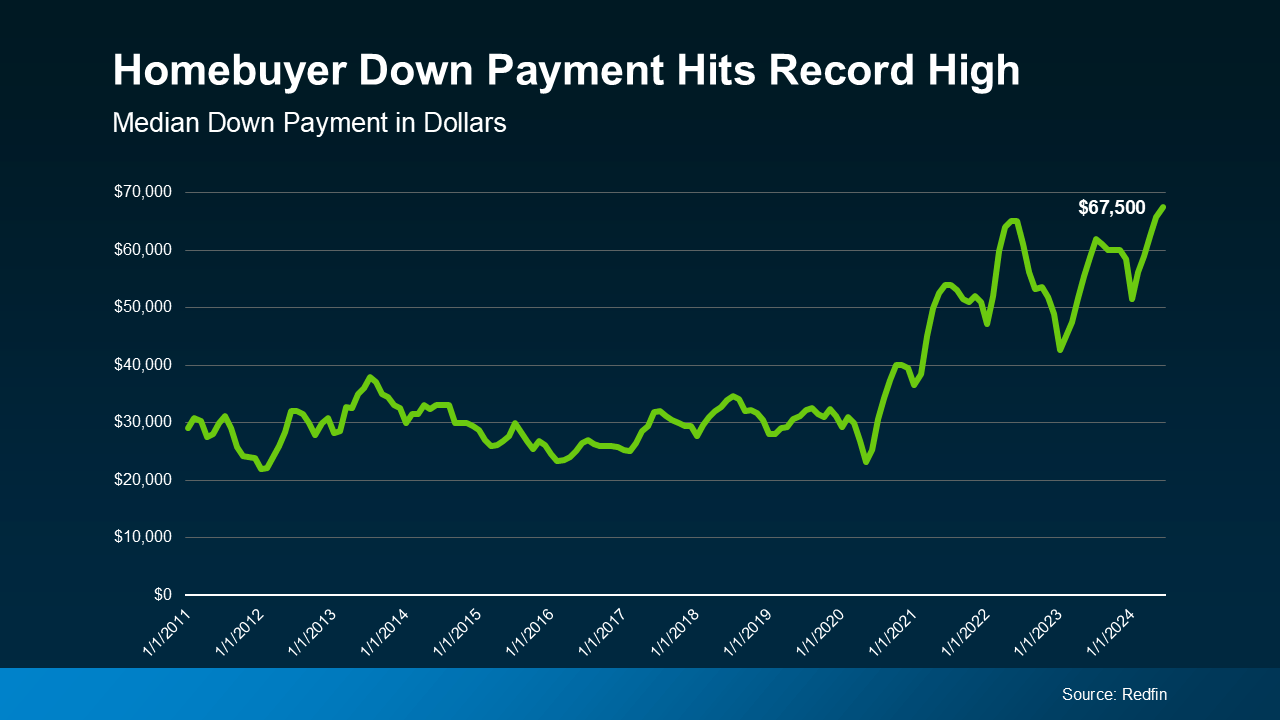

Did you know? Homeowners often have the advantage of making larger down payments on their next home. That’s because, after selling their current property, they can use the equity they’ve built toward the purchase of their new home. As home equity continues to grow, the median down payment has increased as well.

According to recent data from Redfin, the typical down payment for U.S. homebuyers is now $67,500—nearly 15% higher than last year and the highest on record (see graph below):

Here’s how equity makes this possible: Over the past five years, rising home prices have significantly increased the equity homeowners have built. When you sell your current home, you can apply that equity toward a larger down payment on your next purchase. This can be a game-changer, especially if you’ve been concerned about affordability.

It’s worth noting that you don’t have to make a large down payment—some loan programs allow as little as 3%, or even 0%, down. However, many homeowners still choose to put more money down because it offers several valuable benefits.

Why a Bigger Down Payment Can Be a Game Changer

1. You’ll Borrow Less and Save More in the Long Run

A larger down payment reduces the loan amount, which translates to lower monthly payments and significant savings in interest over time. With less debt, you'll have more financial flexibility—whether it’s building your savings, investing, or covering other expenses. Plus, the more you put down upfront, the better your chances of getting favorable loan terms, which can further reduce your overall costs.

2. You Could Get a Lower Mortgage Rate

A bigger down payment not only improves your loan-to-value (LTV) ratio but also makes you a more attractive borrower. Lenders may reward this financial stability with better mortgage terms, including a lower interest rate. Even a small reduction in your rate can result in significant savings over the life of your loan, helping you build equity faster and reduce long-term financial burdens.

3. Your Monthly Payments Could Be Lower

With a larger down payment, your loan amount decreases, which in turn lowers your monthly mortgage payments. This added affordability can give you greater financial flexibility, helping you manage other expenses or save for future goals. Plus, smaller payments can reduce the stress of homeownership, allowing you to enjoy your new home with more peace of mind.

4. You Can Skip Private Mortgage Insurance (PMI)

If you make a down payment of 20% or more, you can avoid Private Mortgage Insurance (PMI), an extra cost that applies when buyers put down less. As Freddie Mac explains:

“For homeowners who put less than 20% down, Private Mortgage Insurance or PMI is an added insurance policy for homeowners that protects the lender if you are unable to pay your mortgage. It is not the same thing as homeowner's insurance. It's a monthly fee, rolled into your mortgage payment, that’s required if you make a down payment less than 20%.”

By avoiding PMI, you'll eliminate an extra monthly expense, providing a helpful financial bonus.

Bottom Line

Down payments have reached record highs, thanks to recent equity gains that allow homeowners to contribute more upfront.

If you're considering selling your current home and making a move, let’s connect to assess your home equity and explore how it can enhance your buying power in today’s market.

Categories

Recent Posts