The Down Payment Assistance You Didn’t Know About

The Down Payment Assistance You Didn’t Know About

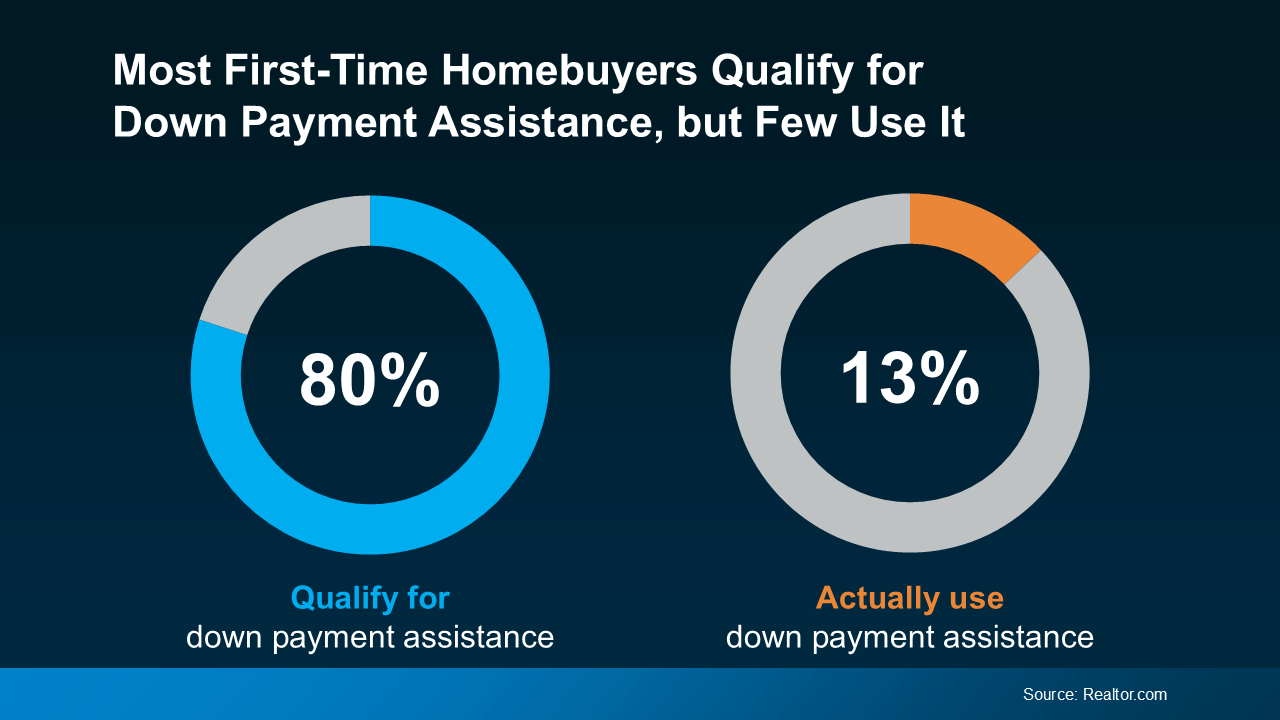

Surprisingly, nearly 80% of first-time homebuyers are eligible for down payment assistance, yet only 13% take advantage of it. If you're looking to purchase a home, closing this gap is essential to make homeownership more accessible (as shown in the graph below).

Here’s what you should know to maximize your down payment in today’s housing market.

Here’s what you should know to maximize your down payment in today’s housing market.

Amplify Your Down Payment Potential

For first-time buyers, it's essential to tap into the various resources available to help with down payments, potentially speeding up the homeownership process. Some loan options allow for as little as 3% down, and even 0% for qualified borrowers like Veterans. Additionally, down payment assistance programs, including grants, can help cover upfront costs.

If you're curious about these options, working with a trusted lender is key. Without exploring what's available, you might miss out on valuable opportunities. A larger down payment could lower your monthly mortgage payments and help you reduce or even avoid fees like private mortgage insurance.

Don’t Let News Headlines About Down Payments Scare You

One more thing to consider is the recent news coverage highlighting the rise in typical down payments. According to a report from Redfin, down payments are indeed increasing.

“The typical down payment for U.S. homebuyers hit a record high of $67,500 in June, up 14.8% from $58,788 a year earlier . . . This was the 12th consecutive month the median down payment rose year over year.”

Don't let those rising figures scare you. The increase in average down payments doesn't mean the requirements are going up. It's important to understand that many people are choosing to put more down in an effort to counterbalance higher mortgage rates. Additionally, current homeowners are leveraging their equity to increase their down payments on their next homes. As HousingWire explains:

“. . . buyers are putting down a higher percentage of the purchase price to lower their monthly mortgage payment. And buyers also had more equity from their home sales, which gives them more cushion.”

Let’s break those two reasons down a bit:

1. A bigger down payment helps lower your monthly mortgage payment. Affordability has been a hurdle for many buyers lately, which is why those who can make a larger down payment are opting to do so to reduce their future housing expenses.

2. Buyers who already own a home have a record amount of equity to leverage. Homeowners who purchased a few years ago have seen their property value increase significantly due to home price appreciation. As a result, they can typically afford to make a much larger down payment than the average first-time buyer who hasn’t yet built up equity.

Bottom Line

The best step you can take is to connect with a trusted lender. They’ll guide you through your current options and help you discover the resources you may qualify for. There are programs available, and working with a professional is key to making the most of them.

Categories

Recent Posts