Today’s Biggest Housing Market Myths

Today’s Biggest Housing Market Myths

You've probably heard the saying, "don't believe everything you hear." This is especially relevant if you're considering buying or selling a home in today's housing market. Misinformation is widespread, making it crucial to have a reliable source for accurate information.

By partnering with a real estate agent, you can debunk common misconceptions and gain reassurance through research-backed facts. Here are a few myths they can help you dispel.

1. I’ll Get a Better Deal Once Prices Crash

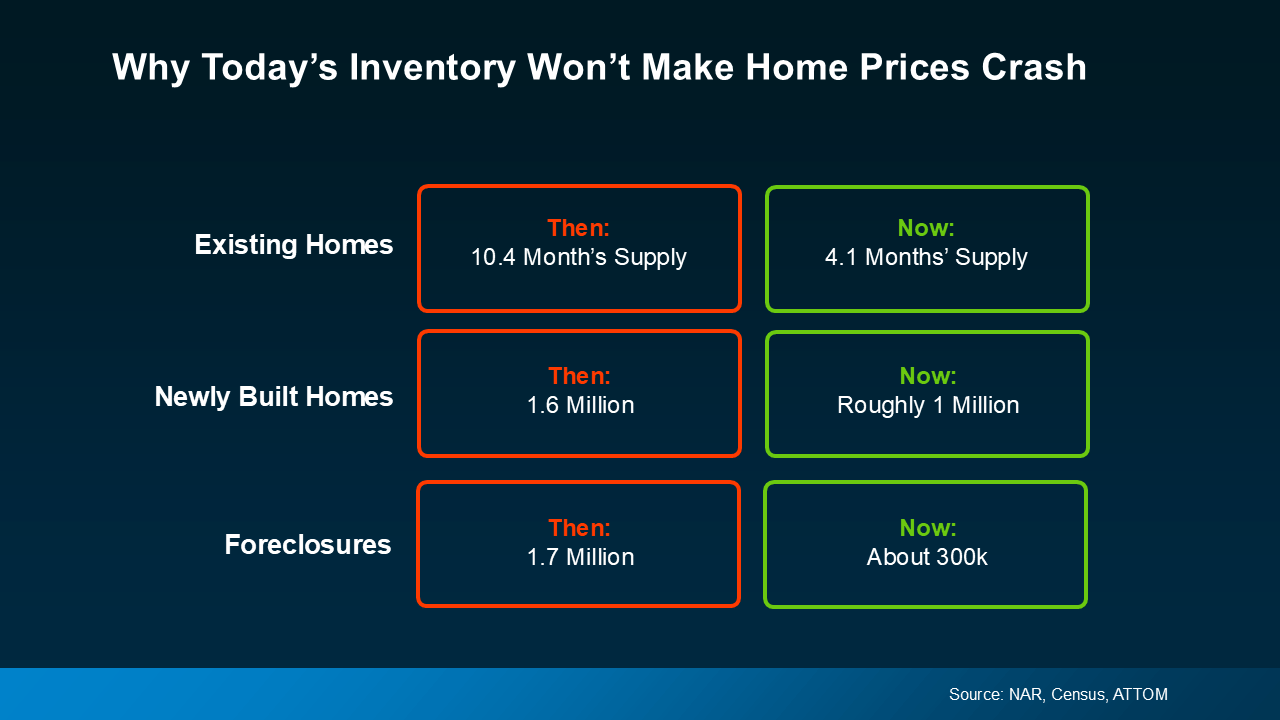

If you've been hearing that home prices are going to crash, it's important to check the facts. While prices can differ depending on the local market, the data consistently shows that a crash is unlikely. Unlike 2008, when an oversupply of homes led to a dramatic drop in prices, today's market is characterized by an undersupply of homes for sale. This significant difference makes the current market scenario quite different from the past (see chart below):

So, if you're holding out in hopes of getting a deal by waiting, it's important to understand that the data indicates a crash isn't likely. Waiting may not lead to the savings you're expecting.

So, if you're holding out in hopes of getting a deal by waiting, it's important to understand that the data indicates a crash isn't likely. Waiting may not lead to the savings you're expecting.

2. I Won’t Be Able To Find Anything To Buy

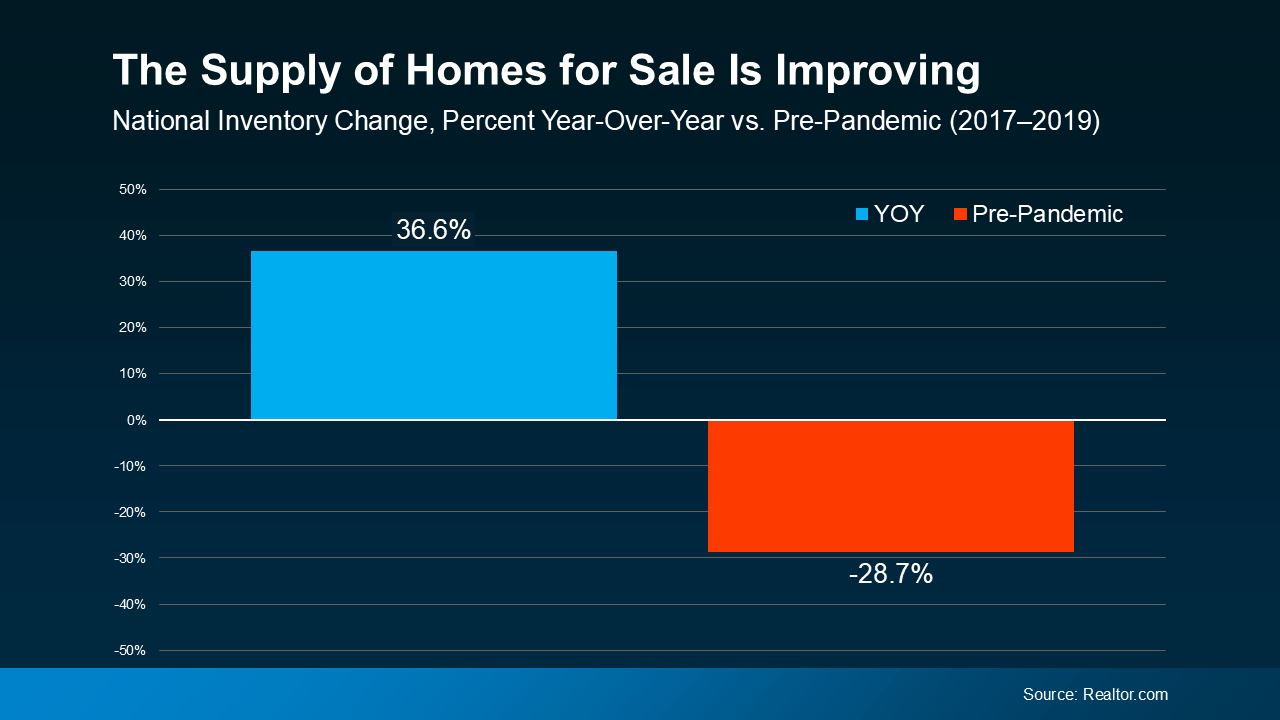

If you're still worried about finding the right home if you decide to move, it might be time to have a conversation with an expert real estate agent. The supply of homes for sale has been increasing throughout the year. While the current inventory is still below what we’d see in a more typical year like 2019, data from Realtor.com shows that it's higher than it was at this time last year (see the graph below):

So, if you're recalling all the media coverage about record-low supply during the pandemic, you can relax a bit. While the market hasn't fully returned to normal, inventory is trending in a healthier direction. This improvement means you can move past the outdated belief that finding a home to buy is nearly impossible—your options are getting better.

So, if you're recalling all the media coverage about record-low supply during the pandemic, you can relax a bit. While the market hasn't fully returned to normal, inventory is trending in a healthier direction. This improvement means you can move past the outdated belief that finding a home to buy is nearly impossible—your options are getting better.

3. I Have To Wait Until I Have Enough for a 20% Down Payment

Many people still believe that a 20% down payment is required to buy a home. To illustrate how prevalent this misconception is, Fannie Mae reports:

“Approximately 90% of consumers overstate or don’t know the minimum required down payment for a typical mortgage.”

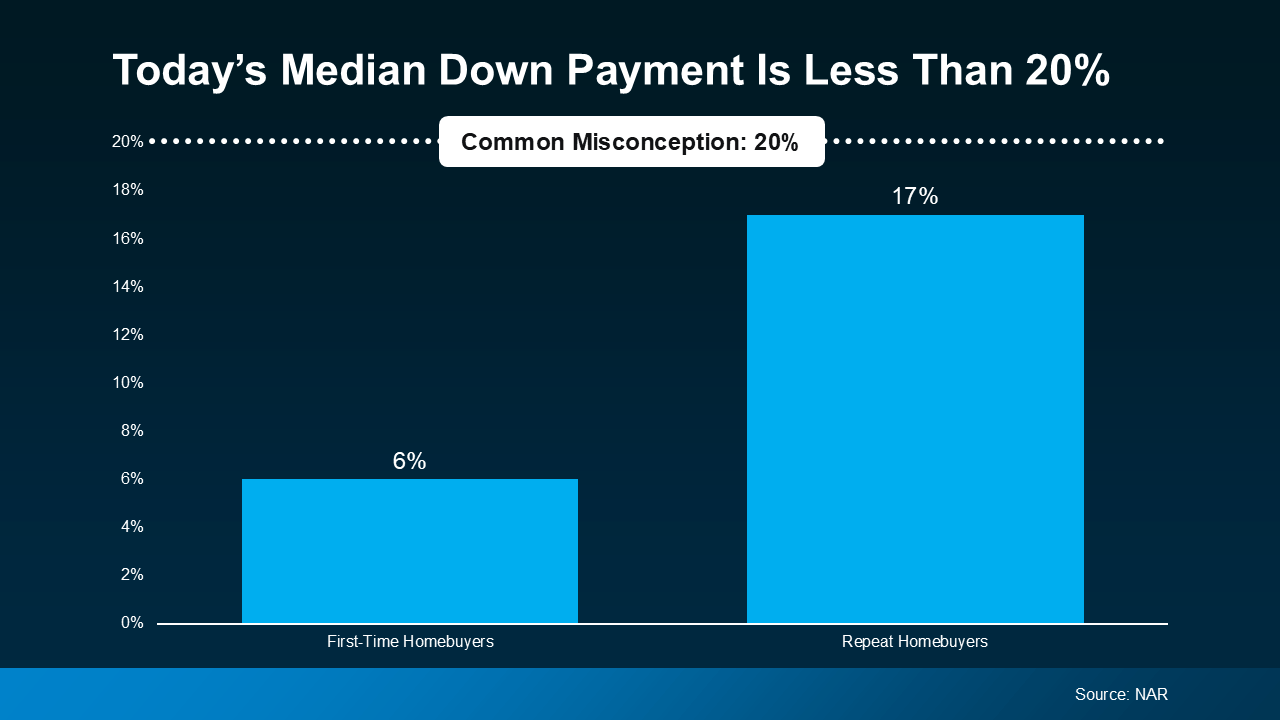

And if you examine the data from the National Association of Realtors (NAR), you'll notice that the typical homeowner isn't making as large of a down payment as you might think (see graph below):

First-time homebuyers are generally only putting down around 6%, which is significantly less than the 20% many believe is necessary. If you're concerned that repeat buyers are closer to that 20% mark, it's important to understand that they often have a large amount of equity from their current home to use for a larger down payment.

This highlights that a 20% down payment isn't always required unless dictated by your loan type or lender. Many buyers put down much less. In fact, depending on the type of loan, you might only need to put down 3.5% or even 0%. So, if you're purchasing your first home, the amount you need for a down payment may be much lower than you expect.

An Agent’s Role in Fighting Misconceptions

If you’ve put your plans on hold because of these common myths, it’s time to consult with a trusted real estate agent. An expert can provide you with accurate data and facts to dispel any misconceptions and help you move forward with confidence.

Bottom Line

If you have any questions about what you’re hearing or reading, let’s connect. You deserve a trusted source who can provide you with the accurate information you need.

Categories

Recent Posts