What Mortgage Rate Are You Waiting For?

What Mortgage Rate Are You Waiting For?

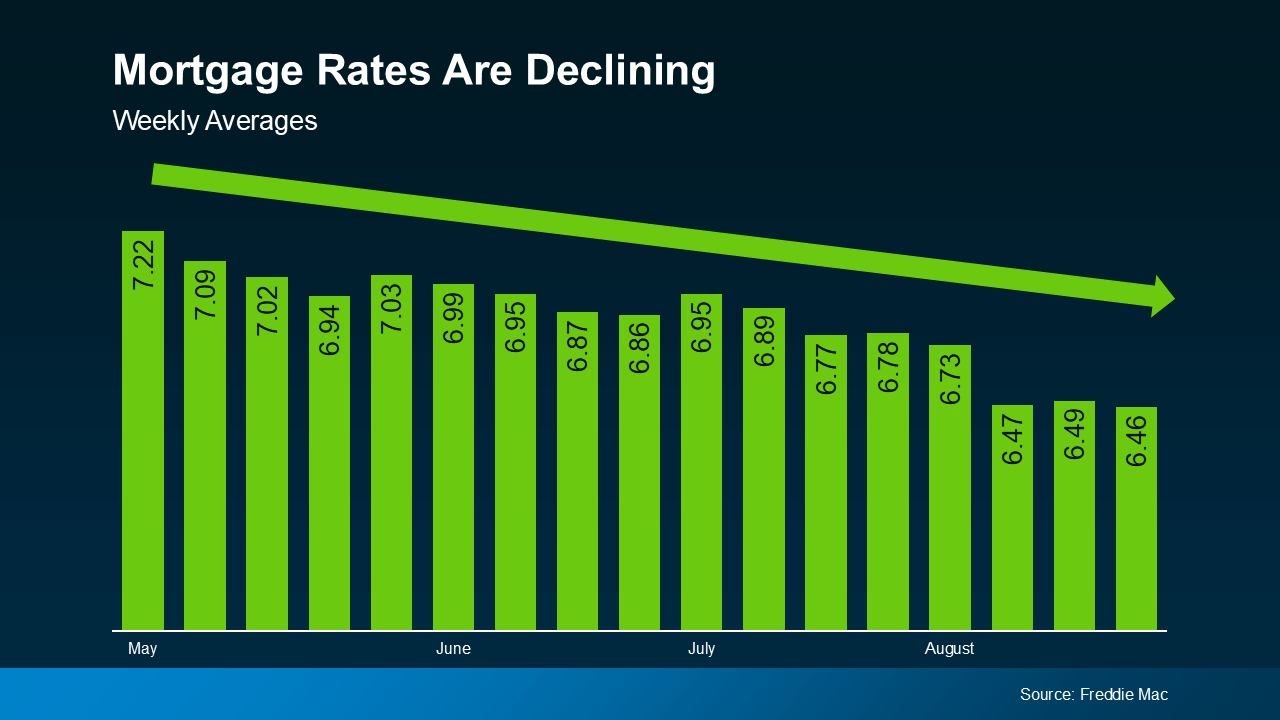

Mortgage rates have significantly impacted housing affordability in recent years, but there’s hope on the horizon. Rates have started to decline, recently reaching their lowest point of 2024, according to Freddie Mac (see graph below):

If you're considering buying a home, you might be wondering how much lower mortgage rates will go. Here's some information to help you understand what to expect.

If you're considering buying a home, you might be wondering how much lower mortgage rates will go. Here's some information to help you understand what to expect.

Expert Projections for Mortgage Rates

Experts suggest that the overall downward trend in mortgage rates should persist as long as inflation and the economy continue to cool. However, expect some volatility as new reports on these key indicators are released.

It’s important not to let those fluctuations distract you from the bigger picture. Rates are currently down roughly a full percentage point from their peak in May.

The general consensus among experts is that rates in the low 6% range are possible in the coming months, depending on economic developments and the Federal Reserve’s decisions.

Many experts are already revising their 2024 mortgage rate forecasts to be more optimistic, anticipating that lower rates are on the horizon. For instance, Realtor.com notes:

“Mortgage rates have been revised slightly lower as signals from the economy suggest that it will be appropriate for the Fed to begin to cut its Federal Funds rate in 2024. Our yearly mortgage rate average forecast is down to 6.7%, and we revised our year-end forecast to 6.3% from 6.5%.”

Know Your Number for Mortgage Rates

So, what does this mean for you and your plans to move? If you've been waiting for mortgage rates to drop, it's already happening. Now, it's up to you to decide when the timing feels right based on expert projections and your budget. As Sam Khater, Chief Economist at Freddie Mac, says:

“The decline in mortgage rates does increase prospective homebuyers’ purchasing power and should begin to pique their interest in making a move.”

As a next step, ask yourself this: what number do I want to see rates hit before I’m ready to move?

So, what does this mean for you and your plans to move? If you’ve been waiting for rates to drop, know that it’s already happening. You just need to determine the rate you’re comfortable with—whether it’s 6.25%, 6.0%, or even 5.99%. Once you have that number in mind, there’s no need to constantly track rates yourself.

Instead, connect with a local real estate professional. They’ll keep you updated on the latest developments and guide you on when to take action. When rates hit your target, they’ll be the first to inform you.

Bottom Line

If you’ve paused your moving plans due to higher mortgage rates, consider the rate that would make you comfortable re-entering the market.

Once you have that number in mind, let’s connect so I can keep you informed and let you know when we reach it.

Categories

Recent Posts