What To Expect from Mortgage Rates and Home Prices in 2025

What To Expect from Mortgage Rates and Home Prices in 2025

Curious about what the housing market might look like in 2025? Experts are sharing some encouraging predictions, particularly regarding two major factors: mortgage rates and home prices.

Whether you’re planning to buy or sell, here’s what experts are saying and how it could shape your next move.

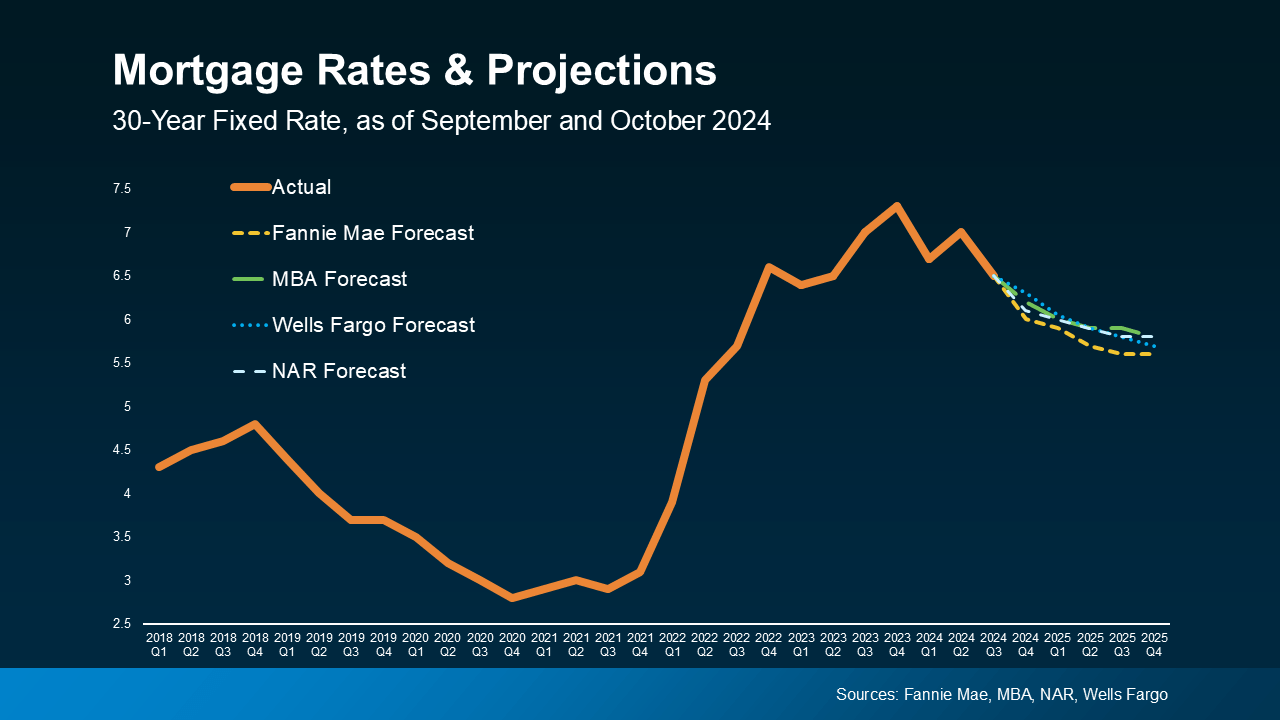

Mortgage Rates Are Forecast To Come Down

Mortgage rates have been a big influence on market activity, and the outlook is promising. After sharp increases in recent years, experts forecast a gradual decline throughout 2025 (see graph below):

While mortgage rates may not drop in a perfectly straight line, the overall trend is expected to move downward throughout 2025. There may be some fluctuations along the way, as rates will respond to new economic data and inflation updates. However, it’s important not to get too caught up in those short-term changes—keeping an eye on the bigger picture is key.

Lower rates will improve affordability, decreasing your monthly mortgage payment and expanding your buying options. This shift could encourage more buyers and sellers to re-enter the market. As Charlie Dougherty, Director and Senior Economist at Wells Fargo, explains:

“Lower financing costs will likely boost demand by pulling affordability-crunched buyers off of the sidelines.”

As more buyers and sellers return to the market, both inventory and competition are likely to increase. The takeaway? You have an opportunity to get ahead of that competition by acting now. Work closely with your agent to stay informed about how shifting mortgage rates are affecting demand in your local market.

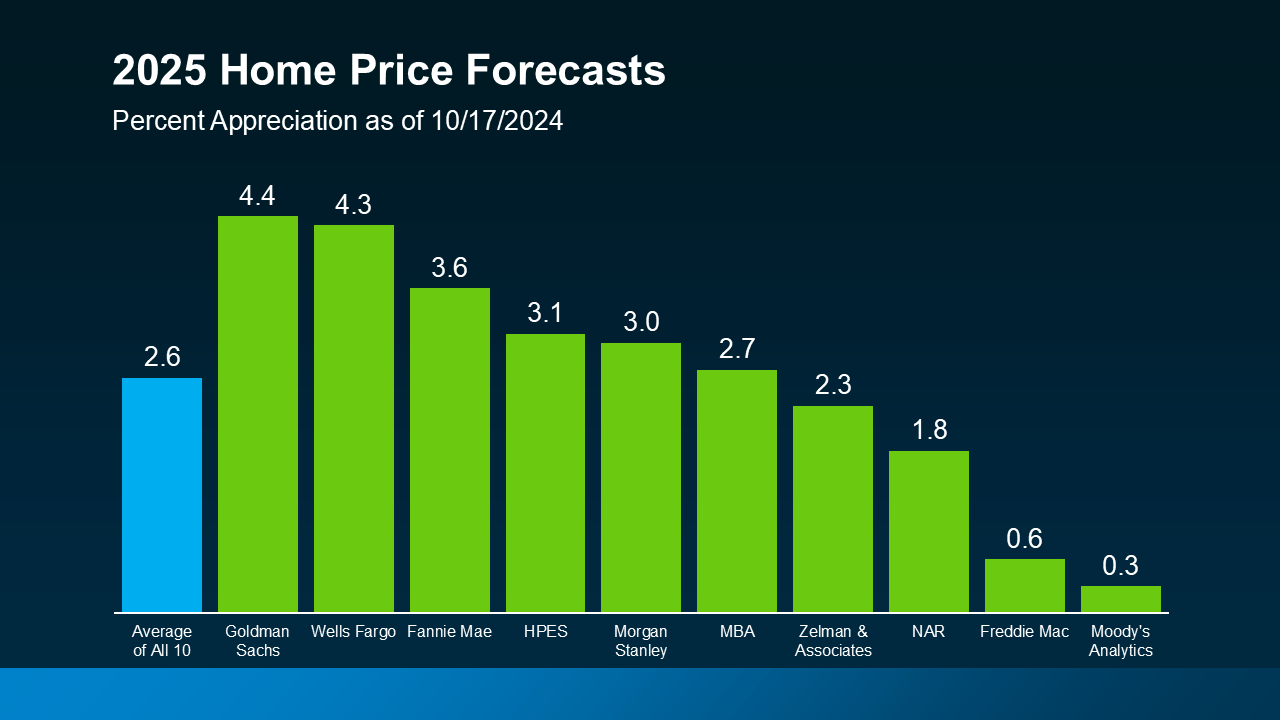

Home Price Projections Show Modest Growth

While mortgage rates are expected to ease slightly, home prices are projected to increase—though at a slower and more sustainable pace compared to recent years. Experts predict that home prices will grow by an average of approximately 2.5% nationally in 2025 (see graph below).

This ongoing price increase is more manageable than the rapid double-digit growth seen in previous years.

The rise in prices is largely driven by demand. As more buyers re-enter the market, demand will increase—but supply is also expected to grow as sellers feel less constrained by high mortgage rates.

In markets where inventory remains below typical levels, higher buyer demand will continue to push prices up. However, an increase in listings should help moderate price growth, resulting in a healthier, more balanced pace.

It’s important to remember that national trends may not fully align with your local market. Some areas could experience faster price gains, while others may see slower growth. As Lance Lambert, Co-Founder of ResiClub, explains:

“Even if the average national home price forecast for 2025 is correct, it’s possible that some regional housing markets could see mild home price declines, while some markets could still see elevated appreciation. That has been, after all, the case this year.”

Even markets that might experience flat or slightly declining prices in 2025 have seen significant appreciation in recent years—so the impact may be minimal. That’s why partnering with a local real estate expert is essential. They can provide accurate insights into the specific trends and conditions in the areas where you’re looking to buy or sell.

Bottom Line

With mortgage rates likely to ease and home prices set to grow more steadily, 2025 looks more favorable for both buyers and sellers.

If you have any questions about how these trends could affect your plans, let’s connect. I’ll help you navigate the market and take advantage of the opportunities coming your way.

Categories

Recent Posts