Tips for Younger Homebuyers: How To Make Your Dream a Reality

Tips for Younger Homebuyers: How To Make Your Dream a Reality If you belong to a younger generation, such as Gen Z, you might be pondering the question: will homeownership ever be attainable for me? It's understandable to feel concerned, especially with factors like inflation, increasing home prices, rising mortgage rates, and other challenges potentially hindering your prospects. While it's undeniable that the current housing market poses challenges for first-time homebuyers, achieving your homeownership goals is still possible, especially with the guidance of professionals. Here are some valuable tips you can expect from a real estate expert. 1. Explore Your Options for a Down Payment If your primary concern is the down payment, there are avenues to bolster your savings. With over 2,000 down payment assistance programs available, homeownership becomes more attainable. Moreover, assistance may come from loved ones, with 49% of Gen Z homebuyers receiving financial support from family members, as per LendingTree. Furthermore, contrary to popular belief, a 20% down payment is not always necessary, unless mandated by your loan type or lender. Collaborate with a reputable mortgage professional to assess your options, determine your actual requirements, and understand any regulations regarding financial gifts from family. 2. Live with Loved Ones To Boost Your Savings Another strategy adopted by many Gen Z buyers involves leaving their rental accommodations and opting to reside with friends or family. This move can substantially reduce housing expenses, enabling accelerated savings growth. As elucidated by Bankrate: “. . . many have opted to stop renting and live with family in order to boost their savings. Thirty percent of Gen Z homebuyers move directly from their family member’s home to a home of their own, according to NAR.” 3. Cast a Broad Net for Your Search Once you've amassed sufficient savings, a professional will assist you in navigating your home search. Given the ongoing scarcity of homes for sale and the challenge of affordability, they'll introduce strategies and options that might not have crossed your mind, broadening your scope of possibilities. For instance, exploring suburban or rural areas is often more cost-effective compared to urban locales. While urban environments offer vibrancy and activity, the lower cost of living in less densely populated areas may warrant consideration. Additionally, contemplating smaller residences like condos or townhouses further expands your entry points into the market. As highlighted by Colby Stout, Research Analyst at Bright MLS: “Being flexible on the types of home (e.g., a condo or townhome versus a single-family home) and exploring more affordable neighborhoods is important for first-time buyers.” 4. Take a Close Look at Your Wants and Needs Finally, a real estate agent can assist you in discerning between your essential requirements and desirable features. It's essential to recognize that your first home doesn't necessarily have to be your forever home. The primary goal is to enter the market and commence building equity. If homeownership is your aim, you might discover that making certain concessions is worthwhile. As Chase emphasizes: “An open-minded approach to house-hunting may be one way for Gen Z homebuyers to maintain some edge. This could mean buying in areas that are less expensive. Differentiating needs vs. wants may help in this area as well.” An agent will help you prioritize your list of home features and find houses that can deliver on the top ones. And they’ll be able to explain how equity can benefit you in the long run and make it possible to move into that dream home down the line. Bottom Line Real estate professionals have expertise on what’s working for other buyers like you. Lean on them for tips and advice along the way. As Directors Mortgage says, with that support you can make it happen: “The path to homeownership may not be a straightforward one for Gen Z, but it’s undoubtedly within reach. By adopting the right strategies, like exploring down payment assistance programs and sharing living costs with relatives, you can bring your dream of owning a home closer to reality.” Let’s connect to get you set up for long-term success.

What's Motivating Your Move?

What's Motivating Your Move? Contemplating selling your home? Take a moment to reflect on the factors motivating your decision. A recent survey conducted by Realtor.com delved into the reasons behind homeowners' desire to sell their homes in the current year. Here are the primary two factors identified: Let's take a closer look and see if they’re motivating you to make a change too. 1. To Make a Profit If you're considering selling your home, you likely have numerous questions swirling in your mind. Fortunately, recent data offers encouraging news: the majority of sellers are seeing substantial returns on their investment upon selling. According to ATTOM, a leading property data provider: “. . . home sellers made a $121,000 profit on the typical sale in 2023, generating a 56.5 percent return on investment.” That’s significant. And here’s one contributing factor. During the pandemic, home prices skyrocketed. There was way more buyer demand than homes available for sale and that combination pushed prices up. Now, home prices are still rising, just not as fast. That ongoing appreciation is good news for your bottom line. Any profit you make can help offset some of today’s affordability challenges when you buy your next home. If you want to know how much your house is worth now and what's going on with prices in your area, talk to a local real estate agent. 2. For Family Reasons Maybe you want to be near relatives to help take care of older family members or to have more support nearby. Or maybe you’re just eager to spend time together on special occasions like birthdays and holidays. Selling a house and moving closer to the people who matter the most to you helps keep you connected. If the distance is making you miss out on some big milestones in their lives, it might be time to talk to a local real estate agent to find a place close by. The National Association of Realtors (NAR) says: “A great real estate agent will guide you through the home search with an unbiased eye, helping you meet your buying objectives while staying within your budget.” Bottom Line If you're contemplating selling your home, there's likely a significant motivation behind it. Let's have a conversation so you can receive assistance in making the optimal move to achieve your goals this year.

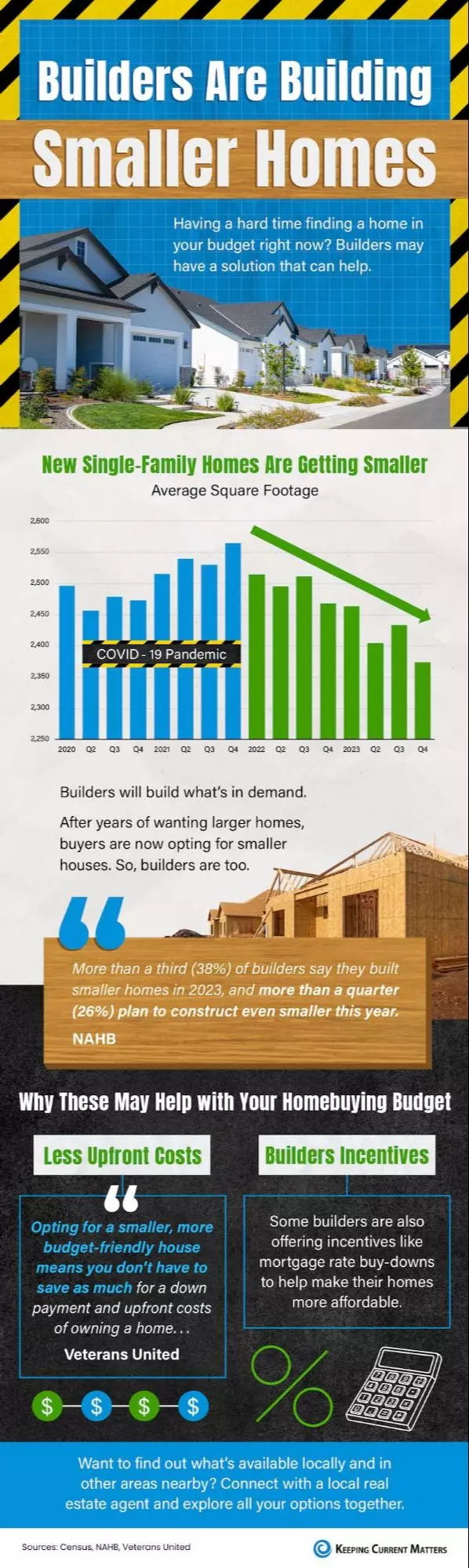

Builders Are Building Smaller Homes

Builders Are Building Smaller Homes Having a hard time finding a home in your budget? Builders may have a solution that can help. Builders are shifting their attention to what buyers want most right now – smaller, more affordable homes. Ready to explore available homes locally and in nearby areas? Let's connect and start exploring your options together.

What Is Going on with Mortgage Rates?

What Is Going on with Mortgage Rates? Mortgage rates are projected to remain elevated for an extended period, contrary to earlier predictions, due to recent economic indicators. Let's delve into the current mortgage rate landscape and what experts anticipate in the near future. Economic Factors That Impact Mortgage Rates Various factors such as the job market, inflation pace, consumer spending, and geopolitical uncertainty influence mortgage rates. The Federal Reserve's decisions on monetary policy also play a crucial role. The Fed's move to increase the Federal Funds Rate in early 2022 aimed to curb inflation and economic growth, indirectly affecting mortgage rates. Despite efforts to alleviate inflation, it remains above the Fed's target rate of 2%, as depicted in the graph below, influencing the trajectory of mortgage rates. As the graph shows, we’re much closer to their goal of 2% inflation than we were in 2022 – but we’re not there yet. It's even inched up a hair over the last 3 months – and that’s having an impact on the Fed’s plans. As Sam Khater, Chief Economist at Freddie Mac, explains: “Strong incoming economic and inflation data has caused the market to re-evaluate the path of monetary policy, leading to higher mortgage rates.” Basically, long story short, inflation and its impact on the broader economy are going to be key moving forward. As Greg McBride, Chief Financial Analyst at Bankrate, says: “It’s the longer-term outlook for economic growth and inflation that have the greatest bearing on the level and direction of mortgage rates. Inflation, inflation, inflation — that’s really the hub on the wheel.” When Will Mortgage Rates Come Down? Based on current market data, experts think inflation will be more under control and we still may see the Fed lower the Federal Funds Rate this year. It’ll just be later than originally expected. As Mike Fratantoni, Chief Economist at the Mortgage Bankers Association (MBA), said in response to the Federal Open Market Committee (FOMC) decision yesterday: “The FOMC did not change the federal funds target at its May meeting, as incoming data regarding the strength of the economy and stubbornly high inflation have resulted in a shift in the timing of a first rate cut. We expect mortgage rates to drop later this year, but not as far or as fast as we previously had predicted.” In essence, this suggests that mortgage rates are expected to decrease later this year. However, the exact timing may fluctuate due to evolving economic conditions, geopolitical tensions, and other factors. Attempting to time the market based on these variables is generally not recommended, as highlighted in an article by Bankrate: “ . . . trying to time the market is generally a bad idea. If buying a house is the right move for you now, don’t stress about trends or economic outlooks.” Bottom Line If you're curious about the current state of the housing market and how it affects your situation, feel free to reach out. Let's connect and discuss your concerns.

Categories

Recent Posts