The Biggest Perks of Buying a Home This Winter

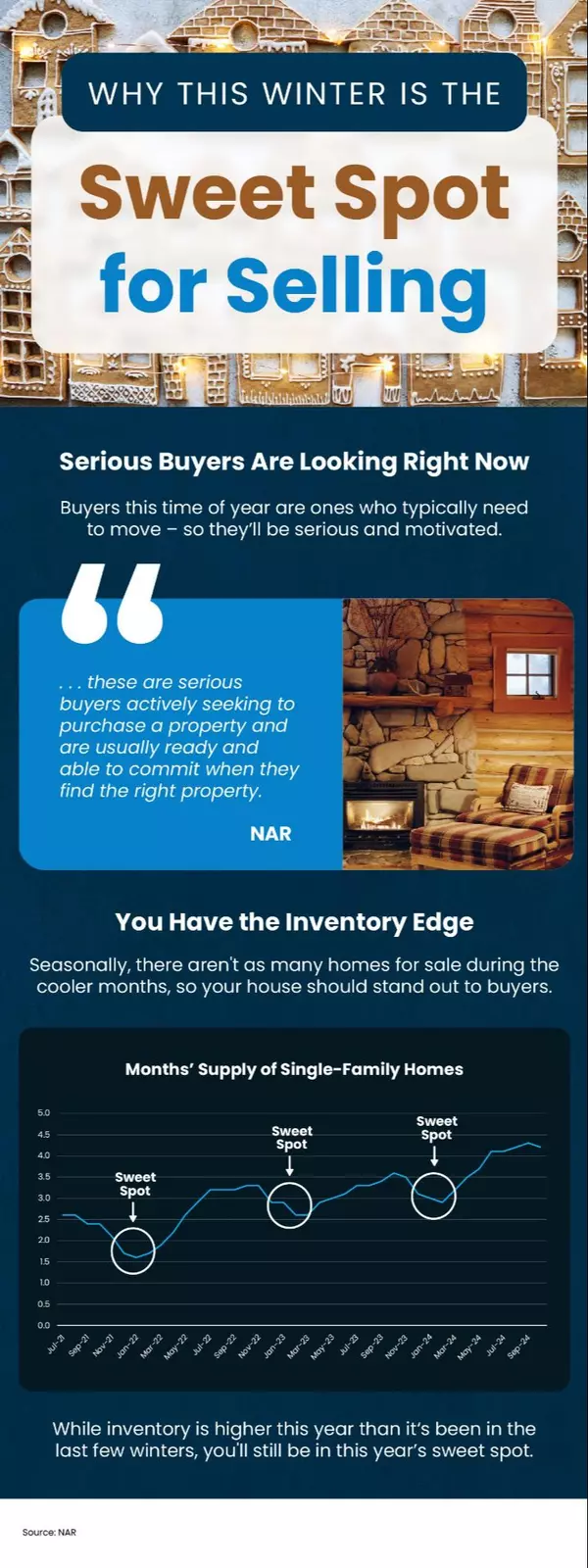

The Biggest Perks of Buying a Home This Winter Waiting for ideal market conditions could mean missing opportunities. If you’re ready and able to buy, this time of year might actually give you an advantage. As the weather cools, the housing market often slows down – and that can work in your favor. You Likely Won’t Feel as Rushed Homes typically take longer to sell during this time of year. Data from the National Association of Realtors (NAR) reveals that the average time a house stays on the market increases during the winter months (see the graph below): Fewer buyers are active during this time of year, which reduces competition. As a result, homes on the market aren’t sold as quickly. If you choose to buy in the next couple of months, you’ll likely have more time to weigh your options and negotiate a deal without as much pressure. Sellers May Be More Willing To Negotiate Since homes typically take longer to sell during the winter, sellers are often more motivated to finalize a deal. As NAR explains: “Less competition can lead to better deals. While homes are not selling as fast as during the summer, sellers may be more willing to negotiate.” Whether it’s compromising on price, covering closing costs or repairs, or including extras like appliances, you have more room to ask for what you need. Homes Are Less Expensive in the Winter With reduced competition from other buyers and sellers who are more open to negotiation, you might also find slightly lower prices. According to NAR, homes are generally about 5% less expensive during this time compared to their peak prices in the summer. That might not seem like a huge difference, but on a $400,000 home, it could mean savings of $20,000 on the purchase price. You can observe this typical seasonal trend in home prices happening again this year. The graph below highlights the median sales price of existing homes (previously owned properties) over the last 12 months. The green bars show how prices dipped during the winter months last year, and it looks like a similar pattern is emerging this year. This seasonal shift could allow your budget to stretch further: Bottom Line Purchasing a home in the winter offers benefits like reduced competition, motivated sellers, and possibly lower prices. Let’s connect to help you find the perfect home at the right price for you.

More Starter Homes Are Hitting the Market

More Starter Homes Are Hitting the Market More entry-level, or starter, homes are becoming available on the market. After years of limited inventory and rising prices, first-time buyers now have more options to consider. Inventory Is Increasing – Especially at Lower Price Points Over the past year, the overall supply of homes for sale has grown. Realtor.com reports that in November, there were 26.2% more homes available compared to the same time last year. This marks 13 consecutive months of inventory growth and the highest number of homes on the market since December 2019. However, this growth hasn’t been uniform across all types of homes. Redfin notes that starter homes have experienced the largest increase (see graph below): If you’re a first-time buyer who’s been waiting on the sidelines, thinking starter homes in your market were out of reach, this could be a turning point. With more options now available, you might finally find one that fits your budget. How an Experienced Agent Helps You Find a Starter Homes Finding the right starter home at the right price can feel overwhelming, but a local real estate agent can simplify the process. They stay informed on the latest listings in your area, ensuring you don’t miss out on opportunities. An agent helps you focus on homes that fit your budget and needs, reducing stress. They’ll also guide you in making the right offer and negotiating for the best outcome. Additionally, they handle key details like paperwork and deadlines, keeping everything on track. If you have questions, your agent provides expert advice every step of the way. Bottom Line Starter homes are making a comeback, and now might be your chance to find one. Whether you're ready to explore listings, seek advice, or simply see what's available, let’s connect.

Only an Expert Agent Can Give You an Accurate Value of Your Home

Only an Expert Agent Can Give You an Accurate Value of Your Home In today’s digital era, it’s easy to rely on automated tools for almost everything — even determining your home’s value. However, be cautious. Online estimates often overlook critical factors that influence your home’s true market value. Before placing a for sale sign in your yard and expecting the figure you saw online, it’s important to understand why these tools are typically off the mark. Partnering with an experienced real estate agent is the most reliable way to get an accurate assessment of what your home is truly worth. The Myth: Online Home Value Estimates Are Accurate Online home valuation tools use publicly available data to estimate your home’s value. While this can be a helpful starting point, it’s important to note that the estimate is only approximate. As an article from Ramsey Solutions explains: “Online Home Value Estimators Aren’t 100% Accurate . . . The estimates are only as reliable as the amount of public record data the real estate websites can access. The less data gathered for your particular neighborhood, county and state, the less you can depend on this number.” The Reality: Online Estimates Miss Key Factors The main drawback of online estimates is that they overlook the unique features of your home and the nuances of your local market. That’s where an agent’s expertise comes in to provide a more accurate valuation. For instance, a real estate agent will also consider: The Home’s Condition: Online tools can’t tell whether your home has been well-maintained or if it needs significant repairs. The condition of your house plays a huge role in its value, and only an in-person walk-through can account for that. The Latest Neighborhood Trends: Is your neighborhood up-and-coming? Are there new developments or amenities nearby that make your home more desirable? Automated tools often overlook local trends that can significantly affect the value of your home. Accurate Comparable Sales: While online estimates may use past sales data as a baseline, they don’t always reflect the most recent or most relevant comparable sales, or comps. Real estate agents, on the other hand, have access to up-to-date market data and can give you a much more accurate estimate based on real-time sales in your area. Agents possess in-depth knowledge of the local market, offering insights that automated tools cannot replicate. As Bankrate explains: “Online estimation tools determine pricing using algorithms that rely on publicly available information. These algorithms can vary widely from one tool to the next and typically don’t account for a home’s current condition or any upgrades or renovations that are not reflected in public records. So they are not as accurate as in-person methods, like a real estate agent’s comparative market analysis . . .” Bottom Line While online home value estimates provide a general idea of your home's worth, they’re not always accurate. The actual value depends on various factors that automated tools may overlook. Let’s connect to ensure you get a precise estimate with expert guidance and the latest market insights to determine the ideal price for your home.

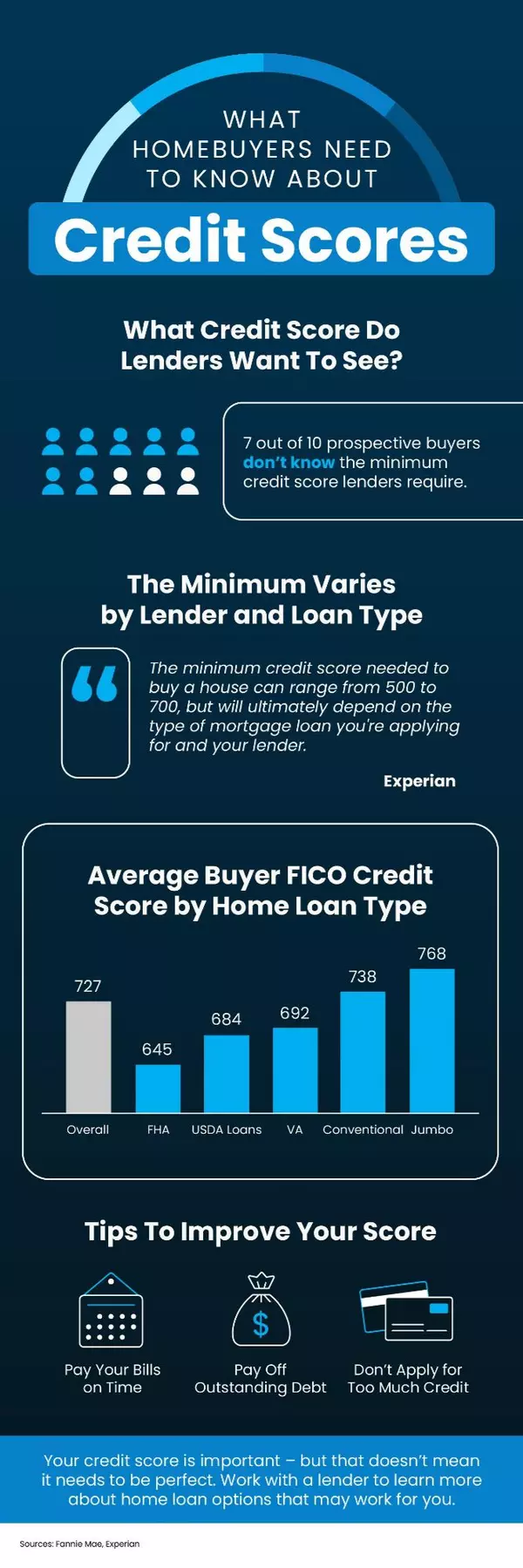

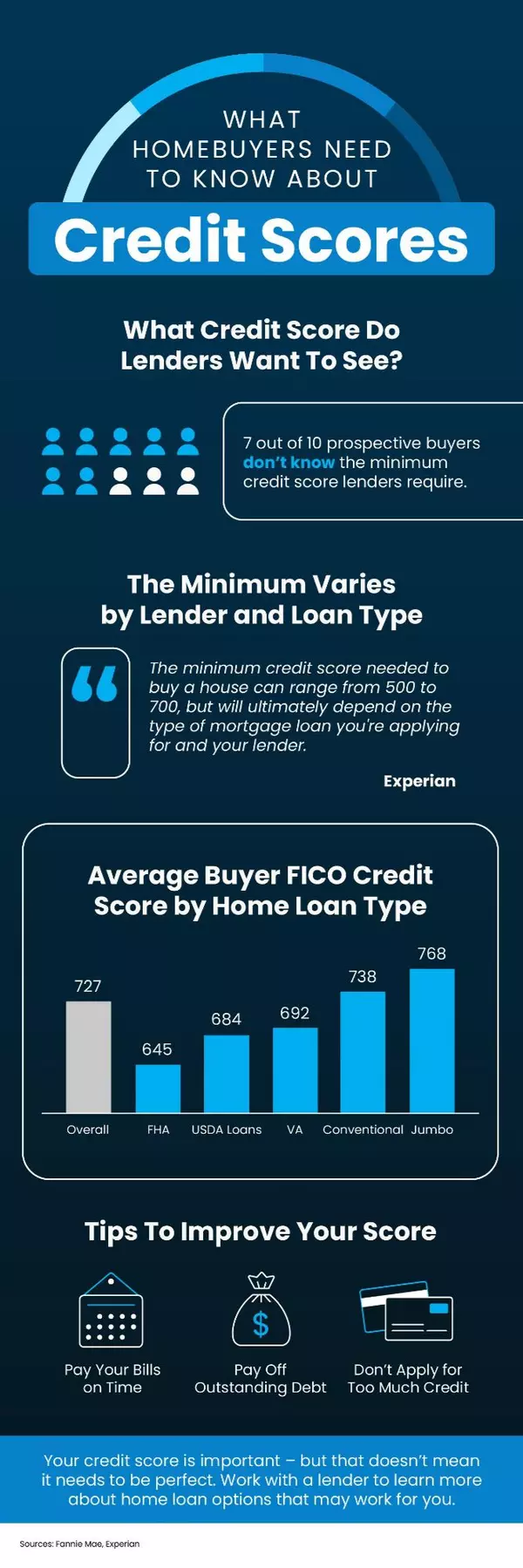

What Homebuyers Need To Know About Credit Scores

What Homebuyers Need To Know About Credit Scores Data reveals that 7 out of 10 prospective homebuyers are unaware of the minimum credit score lenders require or that it varies depending on the lender and loan type. Experian notes that minimum credit scores range from 500 to 700. This means you don’t need a perfect credit score to purchase a home. While your credit score matters, perfection isn’t necessary. Consult with a lender to explore home loan options that could suit your situation.

Categories

Recent Posts