Should You Sell Your House As-Is or Make Repairs?

Should You Sell Your House As-Is or Make Repairs? A recent study by the National Association of Realtors (NAR) reveals that 61% of sellers made at least minor repairs before selling their homes. However, life’s circumstances can sometimes make that difficult, which is likely why 39% of sellers opted to sell their homes as-is instead (see chart below): If the idea of managing repairs or updates feels overwhelming due to limited time, budget, or resources, selling your house as-is might seem like the easiest option. However, before making this decision, here are some important factors to consider. What Does Selling As-Is Really Mean? Opting to sell as-is means you won’t handle repairs or negotiate fixes after the buyer’s inspection, signaling to buyers that the property comes as it stands. This can be a relief for sellers tight on time or budget, but it also comes with trade-offs. Here's a quick overview of the pros and cons to help you decide if selling as-is is the right choice for you. Homes that are updated tend to sell for a higher price since buyers often value move-in-ready properties. Selling as-is might attract fewer buyers, which can result in fewer offers, a longer time on the market, and ultimately, a lower sale price. While this option can save you time and effort, it’s important to weigh the potential trade-offs against the benefits. That doesn’t mean your house won’t sell – it just means it may not sell for as much as it would in top condition. The good news is that 56% of buyers in today’s market are open to purchasing homes that need some work. With affordability challenges and a relatively low inventory of available homes, many buyers are willing to take on repairs or updates themselves, offering you potential opportunities even if your house isn’t move-in ready. How an Agent Can Help To make the best decision for your move, partnering with a professional is crucial. An experienced agent can help you evaluate your options by analyzing comparable sales in your area, identifying updates other sellers are making, and guiding you toward a fair and competitive price. This insight helps you understand what your house could sell for, whether you make updates or sell as-is, giving you the clarity needed to decide. Once you’ve chosen your path and set the asking price, your agent will market your home to highlight its strengths. If you opt to sell as-is, they’ll emphasize key features like the location, size, and potential, helping buyers focus on its opportunities rather than its challenges. Bottom Line Selling your home as-is is certainly an option in today’s market, but it comes with its own set of considerations. To ensure you're making the best decision for your situation, let’s connect and explore all your options together.

Investors Are Not Buying Up All the Homes

Investors Are Not Buying Up All the Homes There’s a common belief that Wall Street is purchasing most of the homes on the market, but the data tells a different story. Experts confirm that investor activity is decreasing, and most investors are smaller, local individuals—like a neighbor with a second property—rather than large corporations. The majority of homes are still being bought by everyday buyers like you. Let’s connect if you’d like to learn more or have any questions!

Control the Controllables If You’re Worried About Mortgage Rates

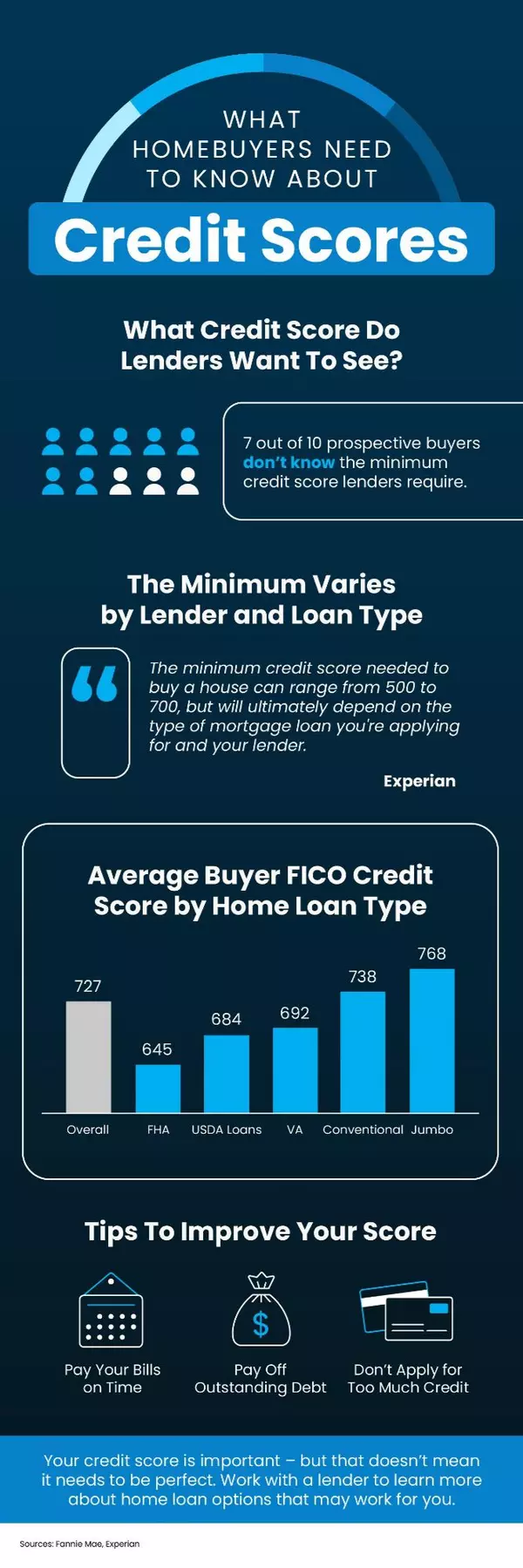

Control the Controllables If You’re Worried About Mortgage Rates You're likely hearing a lot about mortgage rates these days, and like many, you might be hoping they'll drop soon. If the Federal Reserve’s recent early November rate cut caught your attention, you may have expected mortgage rates to follow suit. However, while the Fed’s actions influence the broader economy, they don’t directly control mortgage rates. The reality is that mortgage rates are shaped by a mix of factors, including the Fed’s decisions, the job market, inflation, geopolitical developments, and other economic trends. While recent moves by the Fed may help rates decrease gradually over time, the process will likely be slow and unpredictable. The best advice? Instead of trying to time the market — which can be nearly impossible — focus on what you can control. Here’s how to prepare yourself for a successful homebuying journey, no matter where rates stand. Your Credit Score Your credit score plays a crucial role in determining your mortgage rate, and even a small improvement can have a big impact on your monthly payment. As Bankrate explains: “Your credit score is one of the most important factors lenders consider when you apply for a mortgage. Not just to qualify for the loan itself, but for the conditions: Typically, the higher your score, the lower the interest rates and better terms you’ll qualify for.” In today’s rate environment, having a strong credit score is essential to securing the best possible mortgage rate. To understand your current score and explore ways to improve it, consider connecting with a trusted loan officer for guidance. Your Loan Type There are various loan options available, each with its own set of terms designed for qualified buyers. According to the Consumer Financial Protection Bureau (CFPB): “There are several broad categories of mortgage loans, such as conventional, FHA, USDA, and VA loans. Lenders decide which products to offer, and loan types have different eligibility requirements. Rates can be significantly different depending on what loan type you choose. Talking to multiple lenders can help you better understand all of the options available to you.” Collaborate with your real estate team to explore the loan options you qualify for and determine which one aligns best with your financial situation. Your Loan Term Similar to loan types, you also have choices regarding loan terms or the duration of your mortgage. As Freddie Mac explains: “When choosing the right home loan for you, it’s important to consider the loan term, which is the length of time it will take you to repay your loan before you fully own your home. Your loan term will affect your interest rate, monthly payment, and the total amount of interest you will pay over the life of the loan.” Lenders commonly provide mortgage options with terms of 15, 20, or 30 years. The term you choose directly influences your interest rate, so it’s important to discuss with your lender which option best suits your financial goals. Bottom Line While you can’t predict or control shifts in the broader economy or the timing of lower mortgage rates, you can focus on steps to prepare yourself for success. Let’s connect to discuss the proactive measures you can take now to ensure you’re ready when the time comes to make your move.

How Co-Buying a Home Helps with Affordability Today

How Co-Buying a Home Helps with Affordability Today Purchasing a home in today's market can be challenging, with rising home prices and mortgage rates impacting budgets. If you're feeling uncertain, co-buying might be a practical solution to help you achieve homeownership. As Freddie Mac explains: “If you are an aspiring homeowner, buying a home with your family or friends could be an option.” Before deciding if co-buying is the right choice, there are important factors to consider. Let’s take a closer look at why this approach is becoming increasingly popular among buyers and whether it could be a good option for you. What Is Co-Buying? Co-buying involves purchasing a home with someone, such as a friend, sibling, or even a group of people. With rising home prices and higher mortgage rates, this approach is becoming more common. A survey by JW Surety Bonds reveals that nearly 15% of Americans have already co-purchased a home, while another 48% would consider it. Why Consider Co-Buying? The JW Surety Bonds survey also explored the benefits of co-buying a home. Among the top advantages cited were shared expenses, increased purchasing power, and the ability to afford a larger or better property (see graph below): Sharing Costs (67%): Co-buying can make homeownership more attainable by dividing major expenses like the down payment and monthly mortgage payments, easing the financial burden. Affording a Better Home (56%): Combining financial resources can allow buyers to secure a larger or more desirable home, such as one with extra bedrooms, a spacious yard, or a prime location. Investment Opportunity (54%): Co-buying can serve as a strategic investment, especially if the home is used as a rental property to generate passive income. Sharing Responsibilities (48%): Maintenance and upkeep are part of owning a home, but with co-buying, these tasks can be shared, reducing the workload for everyone involved. Other Co-Buying Considerations Co-buying a home requires a higher level of trust and communication than a traditional purchase. You’ll need to agree on everything from finances to how you’ll use and maintain the property. It’s essential to have a clear plan and a legal agreement in place to protect everyone involved. “Buying a house with a friend or multiple friends might be a great way for you to achieve homeownership, but it’s not a decision you should make lightly. Before diving in, make sure you understand the financial and logistical hurdles you’ll face, as well as the human and emotional elements that might affect the purchase or, more importantly, your relationship.” In essence, it’s crucial to align with your co-buyer on key details such as dividing costs, managing responsibilities, and determining the course of action if one of you decides to sell their share down the line. Consulting an expert can provide valuable guidance, making these discussions smoother and more straightforward. Bottom Line If affordability challenges are holding you back, co-buying might be a practical way to achieve your homeownership goals. However, thoughtful planning and clear communication with all parties involved are key. Let’s connect to explore whether co-buying is the right option for you and help you take the next steps confidently.

Categories

Recent Posts