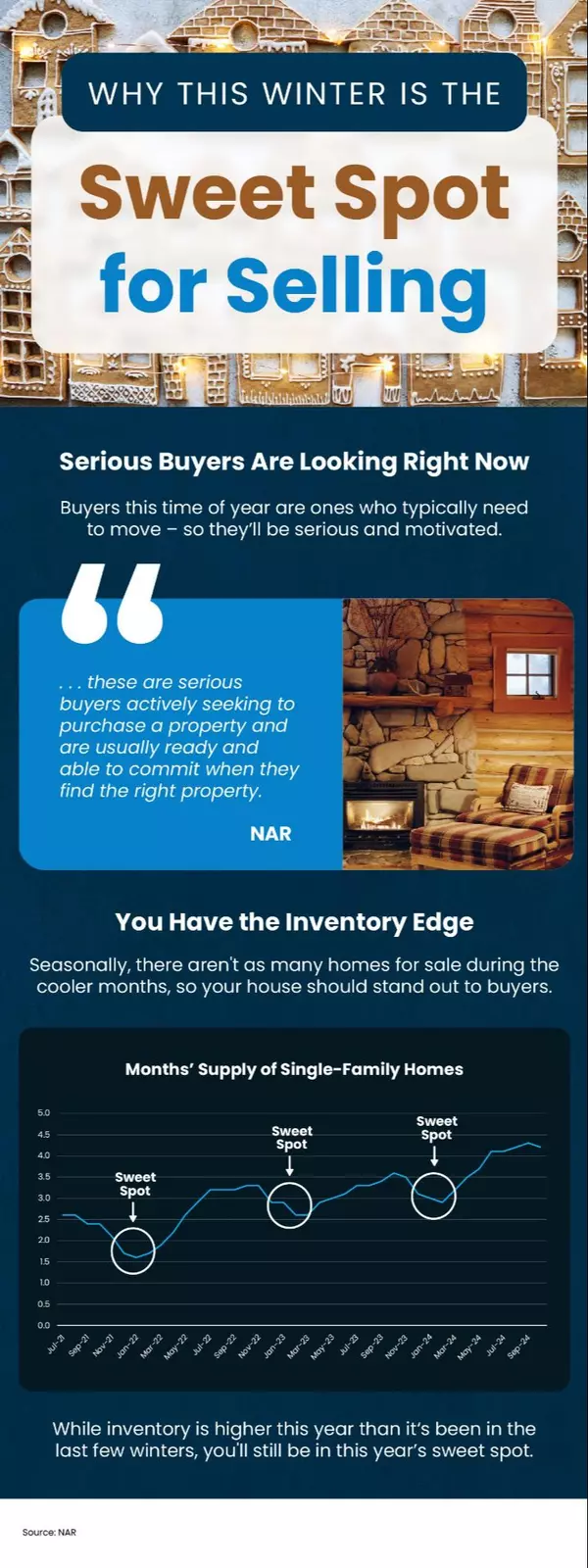

Why This Winter Is the Sweet Spot for Selling

Why This Winter Is the Sweet Spot for Selling Thinking about selling your house? Now might be the perfect time! Serious buyers are on the hunt, and with fewer homes for sale, your house has a great chance to stand out. Even with slightly higher inventory this year, you’ll still hit this season’s sweet spot for selling. Let’s connect!

Why Owning a Home Is Worth It in the Long Run

Why Owning a Home Is Worth It in the Long Run Today’s mortgage rates and home prices might make you question whether buying a home is still a good move. While market conditions are an important consideration, it’s also essential to focus on the bigger picture: the long-term benefits of homeownership. Think about it this way—if you know people who bought homes 5, 10, or even 30 years ago, it’s unlikely you’ll find many who regret their decision. That’s because home values tend to increase over time, contributing to significant growth in a homeowner’s net worth. Here’s a closer look at how that can build over the years. Home Price Growth over Time The map below, based on data from the Federal Housing Finance Agency (FHFA), highlights how home prices have appreciated over the past five years. Because home values differ by location, this regional breakdown helps illustrate broader market trends across various areas. You can see that nationally, home prices increased by over 57% in just five years. While certain regions may have experienced price growth slightly above or below the average, the overall trend shows a significant increase in home prices over a relatively short period. Zooming out further, the long-term benefits of homeownership become even more evident, as the dramatic gains homeowners have achieved over time are highlighted in the data (see map below): The second map reveals that, over a span of approximately 30 years, home prices appreciated by an average of over 320% nationwide. This means the typical homeowner who purchased a house three decades ago likely saw their home's value triple during that time. It's one of the key reasons why so many long-time homeowners remain satisfied with their decision. Bottom Line Today’s market may be challenging, but if you’re prepared to buy, let’s connect. Together, we can navigate the complexities and focus on securing the long-term benefits of homeownership, like building wealth as your home appreciates over time.

When Will Mortgage Rates Come Down?

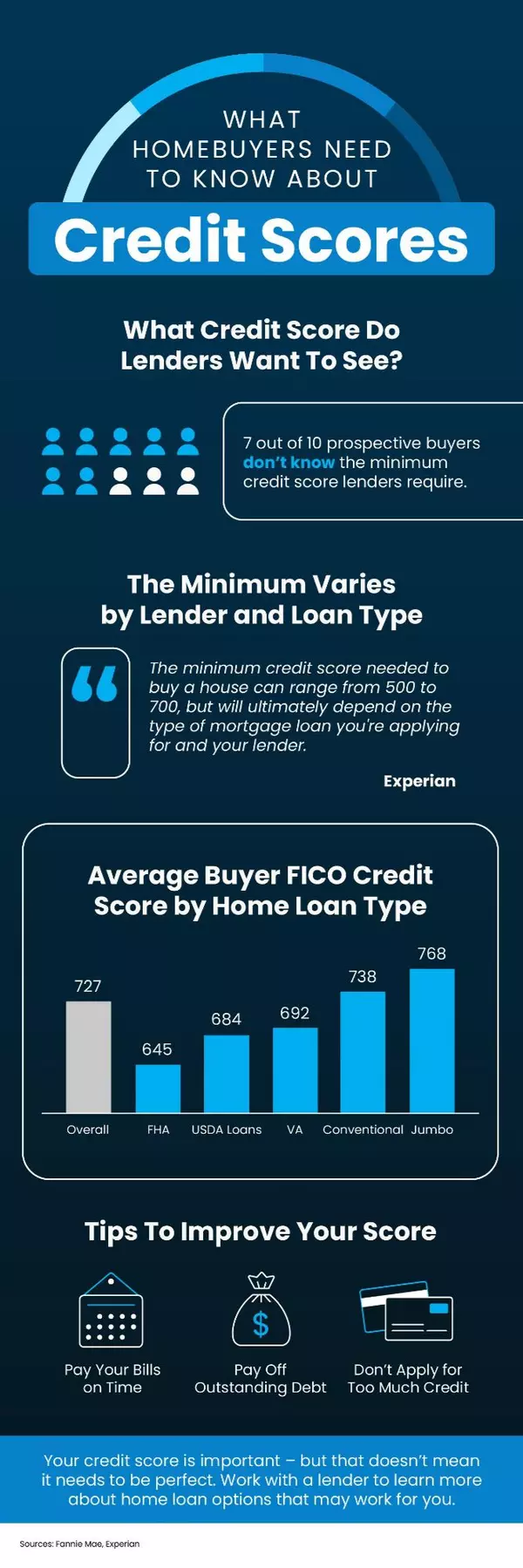

When Will Mortgage Rates Come Down? One of the top questions right now is: when will mortgage rates drop? After years of increases and fluctuations, we’re all hoping for relief. While exact predictions are impossible, experts provide valuable insights into what might happen in the coming year. Here's a look at the latest forecasts. Mortgage Rates Are Expected To Ease and Stabilize in 2025 Recent forecasts indicate that after a period of uncertainty and volatility, mortgage rates are expected to stabilize over the next year. Experts also anticipate a slight easing from their current levels (see graph below): As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says: “While mortgage rates remain elevated, they are expected to stabilize.” Key Factors That’ll Impact the Future of Mortgage Rates Predicting the timing and pace of changes in mortgage rates is one of the toughest challenges in the housing market. This uncertainty stems from multiple key factors needing to align perfectly. While rates are anticipated to decrease slightly, they’re expected to remain a moving target influenced by ongoing economic fluctuations. Here are a few major factors shaping their direction: Inflation: If inflation cools, rates could dip a bit more. On the flip side, if inflation rises or remains stubbornly high, rates may stay elevated longer. Unemployment Rate: The unemployment rate also plays a significant role in upcoming decisions by the Federal Reserve (the Fed). And while the Fed doesn’t set mortgage rates, their actions do reflect what’s happening in the greater economy, which can have an impact. Government Policies: With the next administration set to take office in January, fiscal and monetary policies could also affect how financial markets respond and where rates go from here. These forecasts reflect the most current data, but as new information emerges, experts may adjust their predictions. That’s why relying solely on these projections to time the market isn’t the best strategy. Instead, focus on what’s within your control. Strengthen your credit score, set aside extra funds for your down payment, and automate your savings. These steps will bring you closer to your homeownership goals. Stay connected with a trusted real estate agent and lender to stay informed about the latest updates and receive expert advice tailored to your plans. Bottom Line If you're planning a move and want to stay updated on mortgage rate trends, let's connect. Together, we can navigate the market and set you up for success.

Sell Your House During the Winter Sweet Spot

Sell Your House During the Winter Sweet Spot Many believe spring is the best time to sell a home because buyer demand often rises during that season. However, more homes also hit the market, increasing competition among sellers. The real advantage of selling your house before spring is that it’s easier to stand out. Historically, the number of homes for sale tends to decrease during the cooler months, giving buyers fewer options. Data from the National Association of Realtors (NAR) shows this trend, with inventory dipping during winter and climbing again as more sellers list closer to spring. Understanding this trend gives you a competitive edge. While inventory is higher this year than in recent winters, listing your home now places it in this year’s sweet spot. By selling before the spring surge of new listings, you can take advantage of reduced competition, increasing your chances of standing out to potential buyers. Why wait until spring when you can get ahead of the curve now? Fewer Listings Also Means More Eyes on Your Home Another advantage of selling in the winter is the motivation level of buyers. Those house-hunting during this season are typically serious about making a move. With casual shoppers occupied by holiday activities and cooler weather, winter buyers are often driven by time-sensitive reasons, like job relocations or expiring leases. These motivated buyers are exactly who you want to attract. As Investopedia highlights: “. . . if your house is up for sale in the winter and someone is looking at it, chances are that person is serious and ready to buy.” Bottom Line With fewer homes on the market and motivated buyers actively searching, winter offers an excellent opportunity to sell your home. Let’s connect to kick-start the process and make your move a success.

Categories

Recent Posts